Next session: July 16, 2023

Let’s explore the counterintuitive idea of redistributing by burning money. How deflationary economies work in theory and in practice.

Date: 2023-06-20T09:00:00Z→2023-06-20T16:30:00Z

Location: Flashbots Jitsi (comming soon)

Host

Suggested reading

- Aid in reverse: how poor countries develop rich countries

- The ontological differences between wording and worlding the world

- What is Ethereum?

- EIP 1559 FAQ

- MEV burn—a simple design

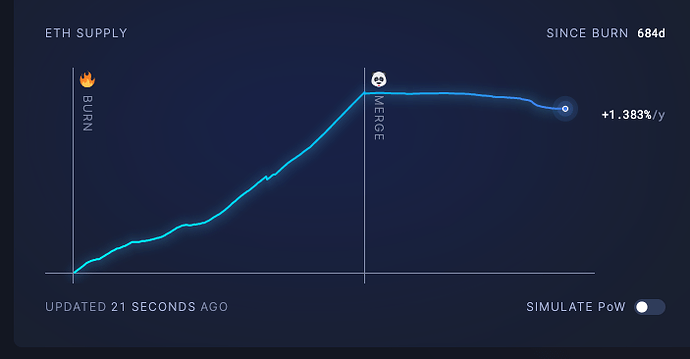

- Ultrasound Money

- Preventing Deflation: Lessons from Japan’s Experience in the 1990s

More information about this club: [Re]distribution study circle

Notes

Chapter 1: Hello, I’m QZ

First 15 min is setting up

5 min - write your intros + what we’d each like to get

out of the session

3 min - intro to today

3 min - burning questions

3 min - we add a +1 each to the questions that we want to focus on so we have an idea of where this will go

Chapter 2: Hello, everyone

![]()

![]()

![]()

Hi, I’m QZ! Currently putting together Ethereum Singapore! I’m your facilitator today and I hope to spark new relationships amongst everyone today through shared interests and curiosity.

![]()

![]()

![]()

I’m also Fred. Part of Flashbots, focusing on our very cool community ![]() .

.

I was previously working with QZ over at Gitcoin. I’m a fan of Ethereum, novel governance and voting mechanism, public goods funding and other related subjects.

gm I’m fred also ![]()

![]()

![]()

GM I’m Sarah! I work with Leo on governance and redistribution research at Flashbots ![]()

![]()

![]()

![]()

![]()

![]()

![]()

Hey!I am Riely. I am doing ecodev at Ethereum Foundation.

Hi, Skeletor here from https://defi.sucks (wonderland). I’m a MEV enthusiast and I work as lead architect. I’m ex yearn core-dev. happy to learn more and discuss about MEV burn. ![]()

![]()

![]()

Hi, I’m Cryptochica, I’m governance coordinator at SEED Latam. I’m co founder of ETH Kipu too. ETH Kipu is an organization co-founded for people from differents countries from Latam. I’m leading the #KipuImpact AREA (Public Goods and QF iniciatives).

Heyo, I’m Quintus from Flashbots. I work on incentive-related research in MEV.

Hi everyone! I’m Parti, the lead researcher at https://defi.sucks (wonderland). I have an academic background, coming from physics. Super excited to discuss the future of MEV ![]()

![]()

![]()

![]() Hi, I’m Miguel from Nethermind. I work on Ethereum infra as a DevOps and builder of node tools. I lead the Sedge project which is node setup wizard with mev-boost support. I’m from Cuba and I love solo stakers.

Hi, I’m Miguel from Nethermind. I work on Ethereum infra as a DevOps and builder of node tools. I lead the Sedge project which is node setup wizard with mev-boost support. I’m from Cuba and I love solo stakers.

![]()

![]()

![]() Hello, I’m Leonardo, redistribution researcher at Flashbots, from Costa Rica, very curious about what we should burn and what we shouldn’t. Sometimes I wake up just wanting to burn it all.

Hello, I’m Leonardo, redistribution researcher at Flashbots, from Costa Rica, very curious about what we should burn and what we shouldn’t. Sometimes I wake up just wanting to burn it all.

Hello! I’m Facundo from Argentina, working at Maker Growth CU, I’m a MEV noob trying to get my head around cross-chain MEV

Hello, I am Dom from EF Research

Chapter 3: Burning questions!

The ontological differences between wording and worlding the world +1 +1

Can somebody share about the way to word the world from Maori philosophy?

What are the words from the aid in reverse that sounded suspicious to you? How is a green country poor?

From the news I hear inflation is bad, and deflation is bad, so what do? I get the sense that economy just sucks.

All the modern big economies are inflationary, how is it that we can make ethereum deflationary? +1

By printing our own money, while all modern societies are commoditized, we are shaping the form of all the relations in those societies. With this opportunity to world the world, why are we replicating so many abusive relations?

The difference between exported and imported money in southern countries puts inflationary pressure on those economies. Would a deflationary economy be better?

How does this relate to the money that flows in and out of ethereum? +1

Is there such a thing as an optimal deflation/inflation point? what are we trying to optimize with this solution? Or is it just a by product of minimizing reward variance for proposers? +1 +1

Is anyone familiar with mmt (modern monetary theory)? My basic understanding re: tax in mmt is that it’s seen as being burnt (to keep inflation down), and gov spending as new issuance. Instead of the traditional way of tax being used to fund gov spending. Idk, might be some interesting correlations.

for Highly profitable MEV bundles, which might require proposer participation. i.e. multiblock MEV. how does MEV burn ensure that the payments are being “burnt”. is it not quite trivial to circumvent proposer payout and have the profit be directly paid to them? is there any penalty for these actors? how can honest participation be incentivized?

What is the interaction between the ether price in dollars and the issuance? How can we claim ethereum to be deflationary if the dollar price is so variable?

Why are we even trying to make Ethereum deflationary? Isn’t it undesirable in that it will increase value transfer to large capital holders and raise the barriers to entry to participation? +1 +1

(^ Isn’t it rather privileging early adopters? Everyone who currently own ETH will gain the same %, regardless of their ize. e.g small holders are not incentivized to lend our their ETH to larger holders for any increase in return)

What is the issuance and burning rate in Ethereum? The stable equilibrium when both are the same and the amount of eth remains stable will happen in 100 years, right? Are humans going to be around in 100 years?

Burning benefits big whales holding a lot of ether, what can we do to mitigate this? +1

Having the congestion and contention oracles on chain gives the protocol a lot of meta knowledge. Are we going to use that meta knowlegde to alter incentives quickly?

Chapter 4: Let’s start!

Is there such a thing as an optimal deflation/inflation point? what are we trying to optimize with this solution? Or is it just a by product of minimizing reward variance for proposers? +1 +1

- just burn eth, make holder benefit?

- maybe distribute among validators? introduce deflation?

- I think distribute among validators was considered in the design but it would introduce some complex incentices? Burning more elegant, harder to collude etc etc.

- haven’t seen discussions on how much to burn

- Ether as collateral for staking vs debt money. fiat is all debt money, want to borrow for cheap and pay later

- the way ethereum works you can’t really compare it with a nation state economy 1 to 1

- eth as a store of money to borrow fiat/stables to buy stuff, more collateral asset goes up more bandwidth the economy

a meta question: maybe there isn’t redistribution to do, let the protocol distribute by itself?

- burning is the least interventionist thing to do, you could give money to individuals/organisations when you allocate but it would be a really active role in what to do with it

- how much should we invest in redistrution strategies? maybe just focus on optimising markets?

- direct distribution mechanisms could change behaviours. eg. extract value from the block and is given back to users, it changes the way people use the chain, they might use it just to get the block value extracted

- people might just spend less ETH if they expect a return (will just hold)

EF Grants - correcting for distribution? will we always need human intervention for this

- is there a governance step for this? or is it temporary?

- things like 1559 are system-wide decisions, made in a more centralised (than others) compared to other more decentralised ways of getting feedback. what ways might a more educated group have suggested/decided. monetary policy tends to go slowly with experts in the decision-making process, what parts could be democratised?

- grants temp/perma? yes temp. how long? 5 years, 10 years, don’t know. if there’s no EF and ethereum continues to grow means the grants are good. considering distributing power, focusing on geographical decentralisation

- rate of return meaningfulness probably depends on other financial options available to people. does an asset that’s more deflationary appeal to different kinds of people, impt qn since we do care about distribution of power

- cryptochica: Personally I am trying to think how to have income to be sustainable in ETH Kipu and continue creating face-to-face courses, research, and empower other communities in Latam. We always think in terms of sponsors, grants. We are trying to think outside of that.

- Wouldn’t deflationary ETH supply make it relatively more attractive to people with inflating local currencies? yes if there isn’t a stable alternative

- why is burn good for the global south? artificial scarcity that we’re putting on the digital world, if this scarcity can generate some stability to generate abundance for the world?

Having the congestion and contention oracles on chain gives the protocol a lot of meta knowledge. Are we going to use that meta knowledge to alter incentives quickly?

- if you start using something that in a way affects other markets, incentives will shift. eg. gas markets then people might have incentive to push up gas prices

- reading on Japanese economy, a takeaway was that it reacted to the deflation too late. how might we as an ecosystem react to this

- oracle data is more of real-time data rather than trends, want to create more reflexive systems rather than things that require human intervention all the time

- all the protocol might do is just try to capture the value from the oracle changes

- changing rate of issuance would have to be a hard fork, will require research to prove that issuance is too low and affecting security

qn: perspective/context how do you see inflation/deflation what would kind of economic system would you like to see on Ethereum?

- wouldn’t want to see high inflation/unstable economy on Ethereum

- solution of burning Eth as something good, rather than relying on an inflationary policy

- Nordic countries: Very high tax. Also very high trust in goverment/authority. Low corruption. Generous healthcare, education and funding of other public goods. Inflation is still relatively high rn at 10%. Not clear correlateions between Nordic system of high taxes and generous wellfare state and deflationary burning of a currency.

- Singapore inherited a colonial economy. Leadership tried to just do the opposite, playing on the strenghts on geopolitical position. Because it’s very small, it’s very easy to adjust the economy. During covid the government put a lot of money, which not a lot of countries can do. The money was not printed, but saved previously. The govenrment can’t have debt, or only for very specific things. Ethereum is the same thing, when it comes to monetary policy is pragmatic, have more options, and don’t go into debt spiral in which you are forced to print money.

- post-colonial nations end up quite wealthy despite not having much resources. feel like there’s some reason for this. could imagine a different world where the opposite might be true. wealth a relative thing, how much money one has depends on how others compare it

- should be clear about lifting up the less wealthy in comparison or the absolute lowest bar

- curious what the goal of redistribution should be?

- wealthier countries giving financial aid but turns out its going the other way round. implication was the wealthier world was exploiting the infra of poorer countries without paying their share. if international corp tax system was fixed, it would just be providing fair value back to these countries

- an opportunity to change the whole framework to how we relate to value

- needs to be some sort of property that one could still use to measure value

- perhaps its these basic building blocks rather than trying to optimise an entire economy, and having these small groups of people organise themselves

Original notes in [Re]distribution study circle, session 1, june 2023: burning money - HackMD

Past session: May 16, 2023