Hey! Making public a list of resources for an event thrown in January 2022 looking at the MEV industry in 2021 (MEV in 2021 – A Year in Review). In particular, a presentation I gave there was focused on quantifying extracted MEV on several chains (Ethereum, BSC, Polygon, Avalanche). Below is the data I used and would use if I would re-do the exercise this year consisting in trying to quickly estimate a lower bound for Total Extracted MEV.

Per Domain

for Ethereum:

- MEV-Explore https://explore.flashbots.net & mev-inspect-py

- for completeness, i recommend to use mev-inspect-py since mev-explore filters out some forms of MEV.

- for MEV-Boost data in particular, there are several sources to use but ‘extracted MEV’ shouldn’t have changed a lot from PoW to PoS so the above should work!

for Polygon:

- this dashboard by Marlin: https://explore.marlin.org/

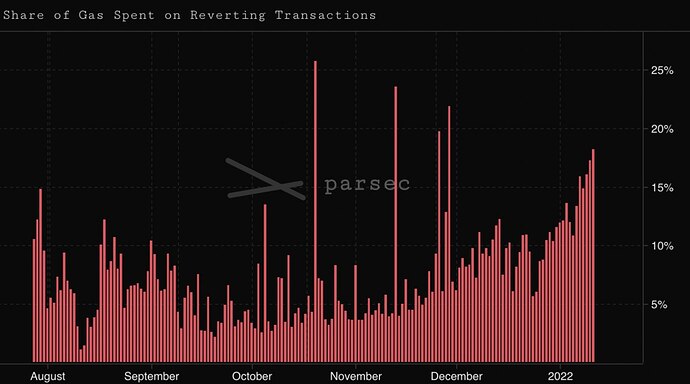

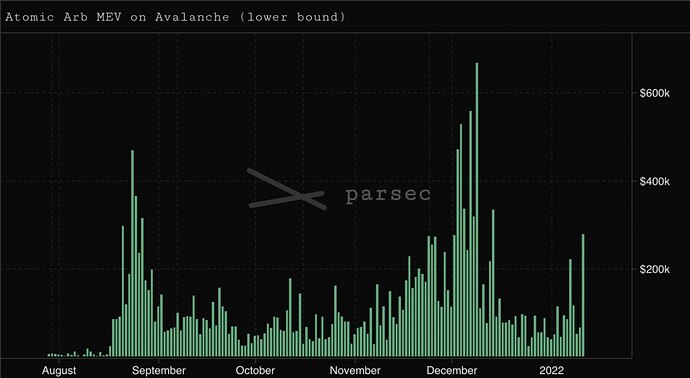

for Avalanche:

- below are screenshots of Parsec numbers. Thanks to Will Sheehan for sharing these numbers. Will Sheehan is the person to talk to for updated numbers!

- here is an exchange with Will (Parsec) from back then:

Alex: do you have any data before August? what's the methodology to determine what's an arb? what about methodology to convert to USD?Will Sheehan: august 1 is as far back as our data goes currently. methodology was uniswap-v2 style Swap() that are chained amountOut = amountIn on the inside and same currecny on the bookendsdaily converts of avax -> USD, only other loops I looked at were stablesAlex:I seee, thank you this is super helpfuland how big do you think liquidations are on top of that $18.8m?Will Sheehan:I can run a few quick scripts to estimate in a few hours, my guess would be less but substantial, maybe 2-5ishAugust 1 is start date for both!

for BSC:

- here are numbers from EigenPhi for a part of 2021.

BSC Arbitrage Scan Stat (2).pdf (276.6 KB). Thanks a lot to them for sharing those numbers back then and being so responsive!

here is some additional info from exchange with them:

-

Alex: How do you define 'spatial' as a category? how do you define 'combination'?EigenPhi: An arbitrage deal involving two tokens and traded between two different LPs (markets), is a spatial deal. A combination can involve multiple tokens (four or even more) in one arbitrage deal, or one smart contract contains multiple spatial and triangular deals.

-

Alex: What's the methodology to determine that a trade is an arbitrage? What's the methodology to convert to USD?EigenPhi: A long story to short, our methodology aims to reduce multiple transactions to a simple one which makes profits out of those multiple transactions in one smart contract.

-

Alex: Does an arbitrage transaction profit discount the transaction fee that tx paid?EigenPhi: Yes, gas fee deducted

-

Alex: Do you have some idea of what the activity was like before June 2021? On DefiLama I can see that BSC TVL grew April/May, so I assume arb activity before June was quite low or non-existent?EigenPhi: Sorry I'm afraid we're not able to comment due to lack of original data. We may look back the data of 2021 Jan - May once we have resources.

-

Alex: I can see you don't quantify liquidations currently, is that something you're thinking of doing in the future? :)EigenPhi: Yes

for Solana:

- here is a dashboard from Jito Network - Retool

for Cosmos:

- here is a dashboard from Skip (that is only covering part of the Cosmos ecosystem) https://satellite.skip.money/

what’s missing/could help?

- L2s – we have a few research proposals to work on this. see for eg Quantifying MEV on L2s

- also @Quintus worked on this, here his university report: https://timroughgarden.github.io/fob21/reports/r11.pdf

- Avalanche – there are known searchers that can be asked for ballpark figures for 2021 & 2022.

- Fantom & some other chains, also have known searchers can ask!

- cross-domain – there isn’t a clear-cut methodology for how to estimate this yet although it’s exciting to try. see also: We're going to estimate a lower bound of cross-domain MEV. there are some internal efforts at flashbots to do this better

happy to jam on this here too!

happy to jam on this here too! - CEX-DEX stat arb – some of it is encompassed in the above but not fully probably, this is also probably a large chunk (and multiples bigger than all on-chain MEV today).

…

add your own in this thread!

tangential content:

- A brief Survey of MEV on Ethereum, BSC, Avalanche and Polygon in 2021 - Alex Obadia (Flashbots) - YouTube – MEV Year in Review (Jan 2022), presentation from yours truly. It uses the content above so no need to watch it unless you wanna be more familiar with it and hear additional thoughts & context. for eg. i think we can estimate lower bound of MEV on most chains as a function of TVL & volumes traded) –

- MEV across crypto in 2021 presentation from @bert (it has numbers & some rough estimations) – MEV across crypto in 2021 - Robert Miller (Flashbots) - YouTube

- MEV on Ethereum Wrapped by Luke Van Seters (really great additional context on MEV numbers, super cool presentation using mev-inspect-py, highly recommend) – 2021 Ethereum Wrapped - Luke Van Seters (Flashbots) - YouTube