Thanks for edits, reviews & comments from Michael Silberling at OP Labs, GaussianProcess and Flashbots mates @bert, @Fred, @dmarz, @Hasu, @elainehu, @tesa!

In this post, we aim to provide a data overview of the current state of L2s. We examine the significance of L2s gas reduction from the Dencun upgrade in March, investigate how activities on these networks have evolved, and highlight emerging challenges driven by MEV activities. Additionally, we discuss the potential hurdles in developing MEV tooling and solutions for L2s.

The Good: L2s Adoption post Dencun Upgrade

Gas Cost Went Down by 10x

The gas fees on Ethereum Layer 2s (L2s) are comprised of two components: The cost for executing transactions on the L2, and the cost for submitting batched transactions to the Ethereum L1. The specific L2 gas fee structures and sequencing rules vary between different L2s, depending on their stages of development and design choices. For instance, Arbitrum operates on a First-Come-First-Serve (FCFS) basis where transactions are processed in the order they are received. In contrast, Optimism (OP Mainnet) and Base, which are part of the OP Stack, utilize a Priority Gas Auction (PGA) model that incorporates both an L2 base fee and a priority fee. Users can choose to pay higher priority fees to be included faster and earlier in a block. Understanding the fee structures is essential to understand the ecosystem’s growth and MEV dynamics.

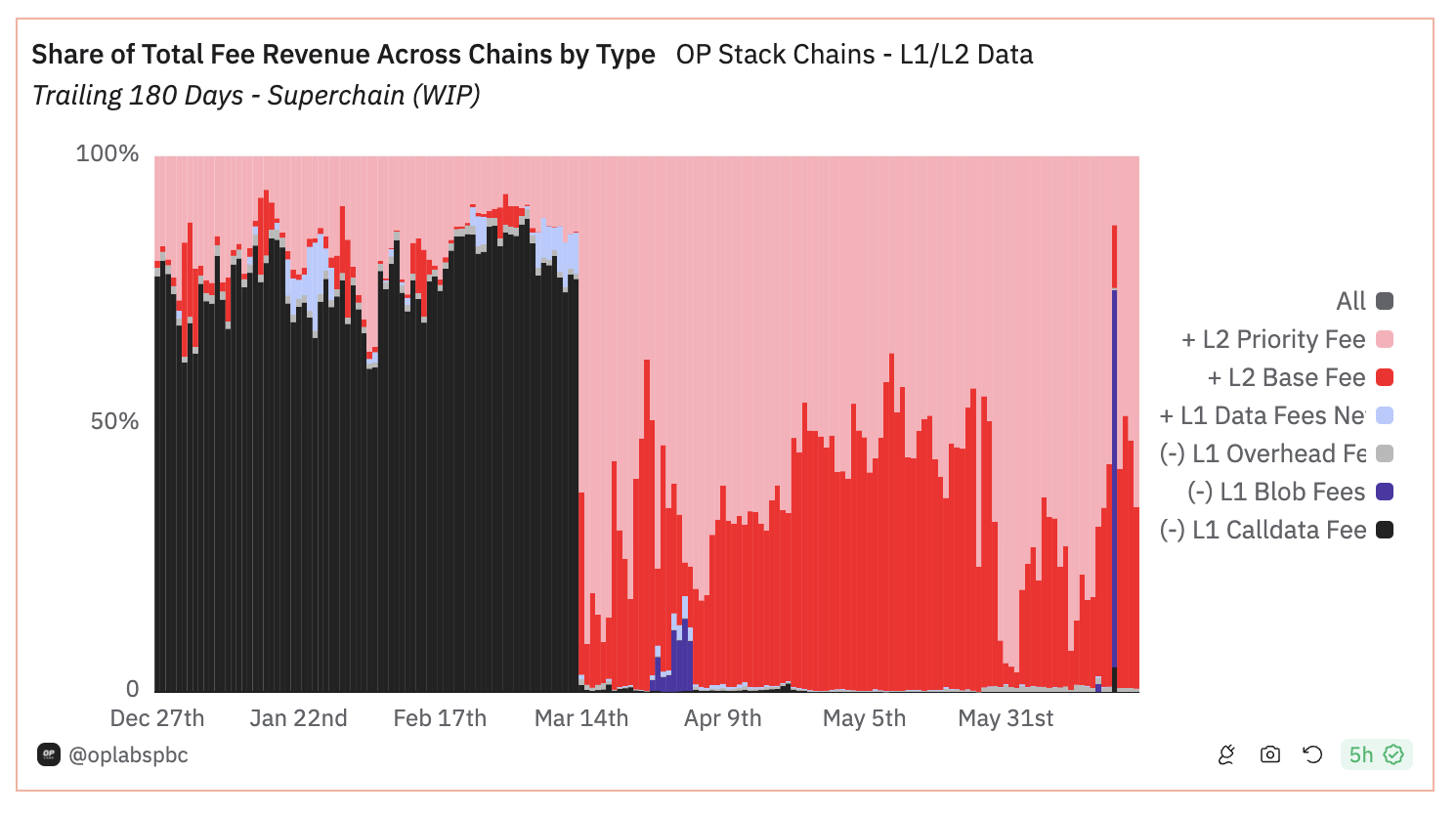

Historically, L1 fees on Ethereum have constituted the majority of the total fees users incur when transacting on L2s, accounting for over 80% of the costs, as illustrated by the black bars in the chart above. However, following the Dencun Upgrade on March 14th, L2s transitioned from using calldata to a more cost-effective method known as ‘blobs’ for submitting batches to L1. This temporary storage incorporates its own gas auction, consisting of a blob base fee and a priority fee.

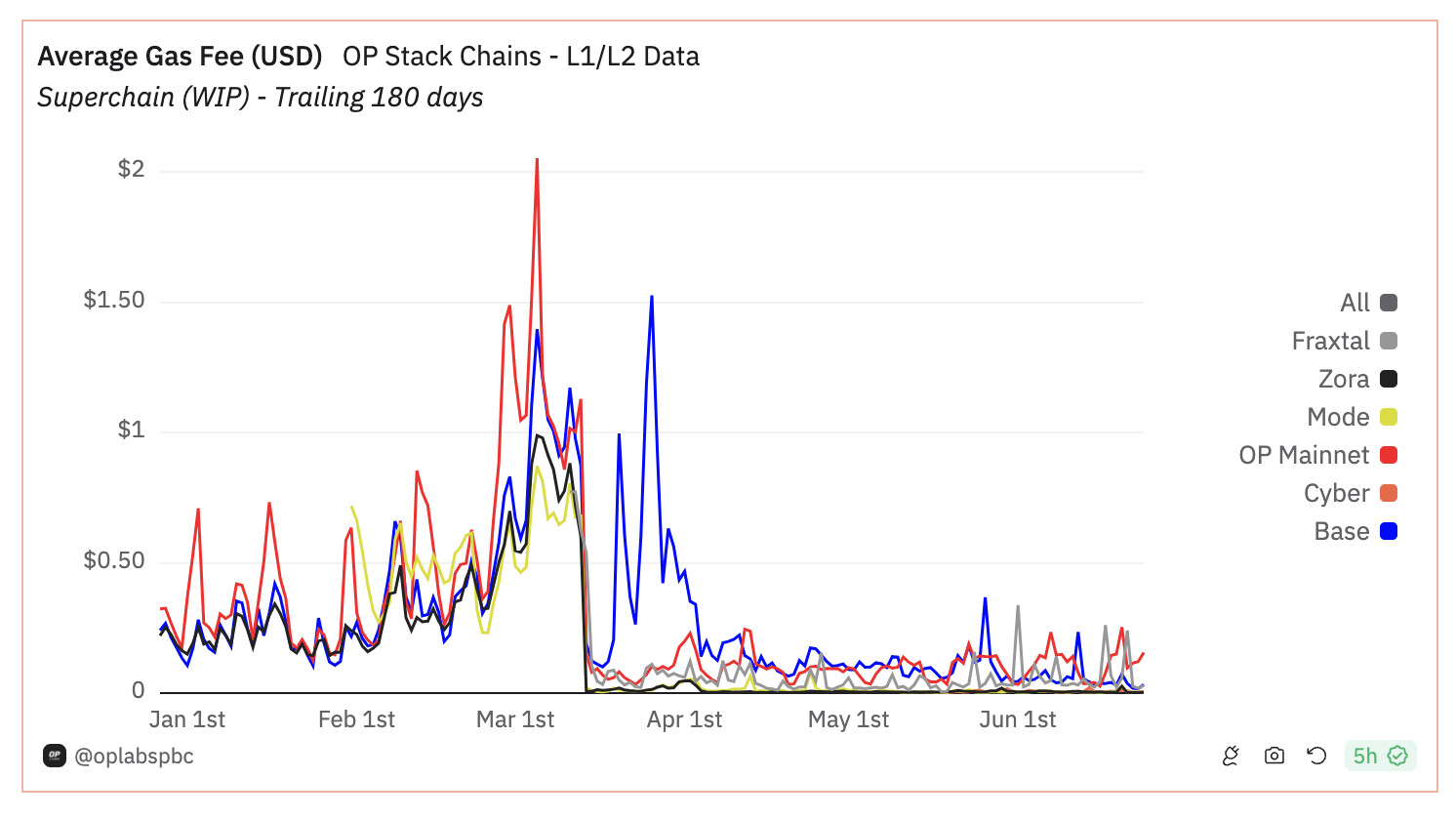

Since Dencun, there has been a significant reduction in L1 fees paid by L2s — the chart indicates a major shift in the OP Stack chains’ gas cost breakdown, with L1 costs plunging from 90% to just 1%, and L2 costs now comprising 99% of the total. This transition has led to an overall decrease in average total gas fees across L2s by approximately tenfold, with OP Mainnet’s average gas fees, for example, plummeting from around $0.5 to $0.05 per transaction.

L2s Activities Surged Afterwards

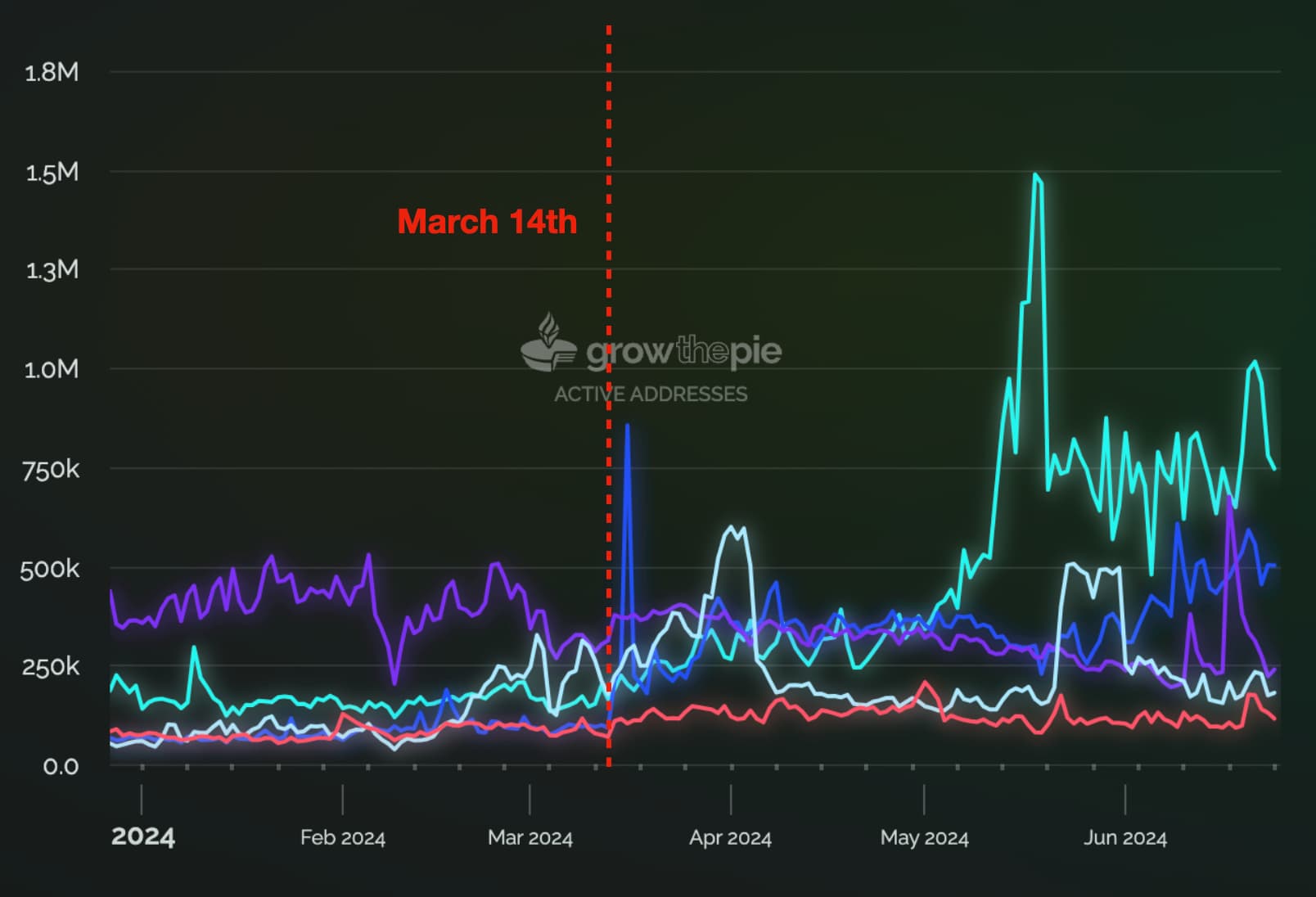

Following the cost reduction, there was a noticeable surge in activity and usage across L2s, as evidenced by the spikes in L2s’ gas fees depicted in the charts above. Notably, on March 26th, the average gas fee on Base exceeded its highest level recorded just before the upgrade. To accommodate more transactions and reduce network congestion, Base raised its gas targets starting around March 26th, and made several adjustments thereafter.

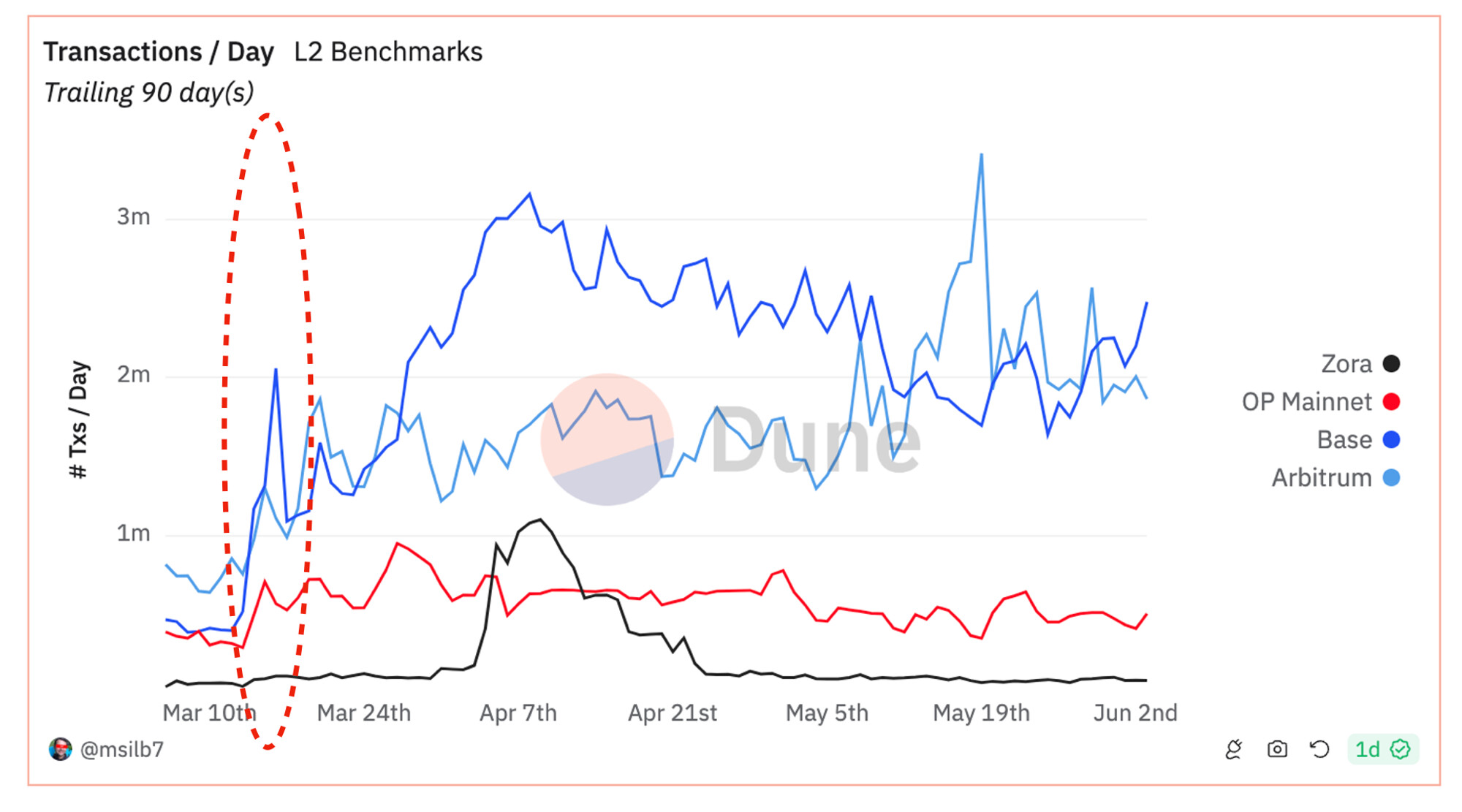

The chart below highlights the daily transaction counts on L2s, showcasing significant growth on networks such as Arbitrum, Base, and OP Mainnet. Specifically, Base has seen a fourfold increase in its daily transactions, now processing around 2 million transactions daily.

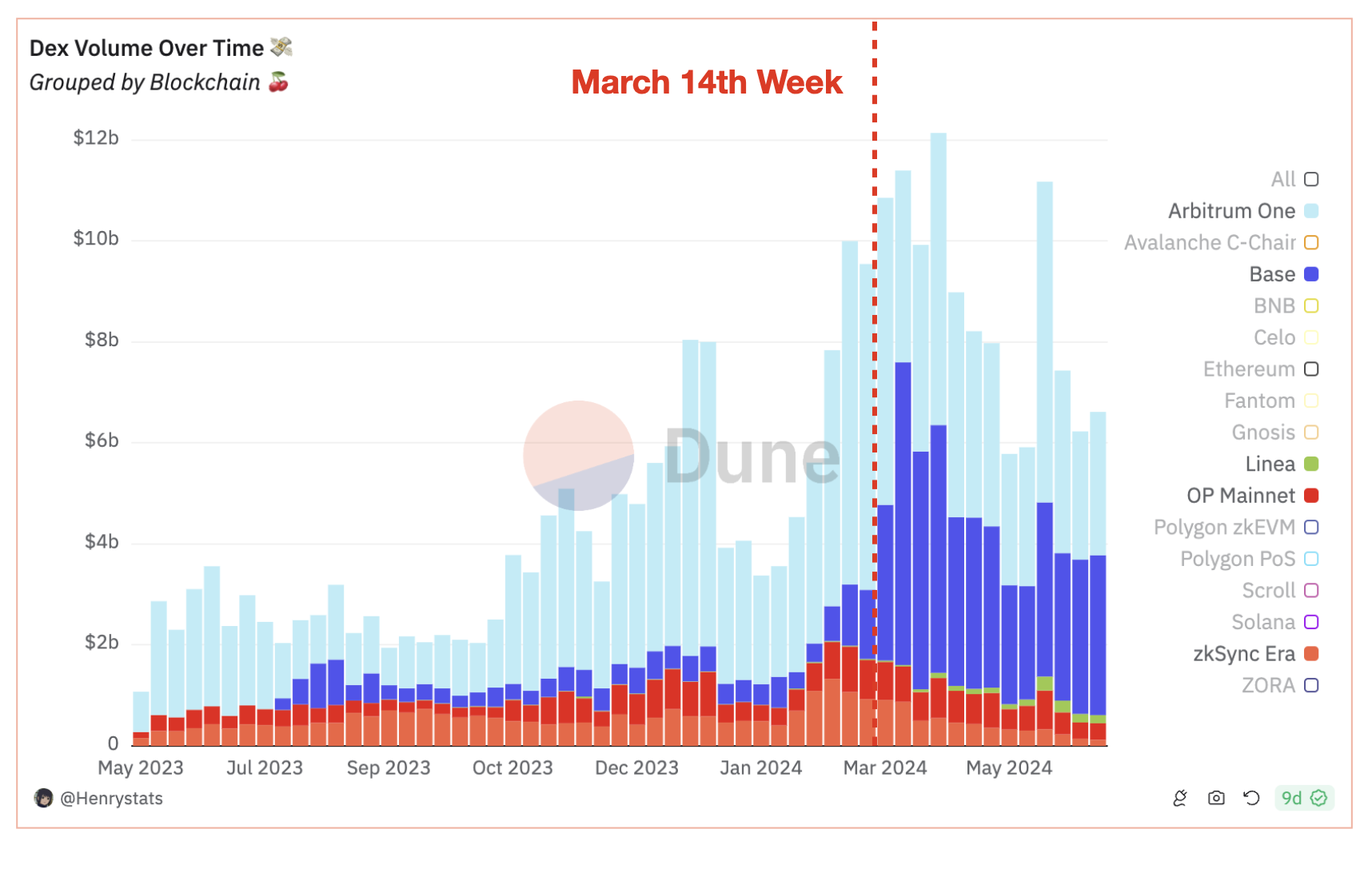

Although it is challenging to determine if it is a result of organic engagement or influenced by incentive programs and Sybil activities — there has been a clear increase in active addresses and DEX volumes across all major L2s with the EIP-4844 upgrade, particularly on Base and Arbitrum.

Assets Moving to L2s

With market conditions improving and the onset of memecoin season sparked by $WIF on Solana, there has been a consistent rise in Total Value Locked (TVL) across L2s since late last year. Notably, Base has emerged as the fastest-growing chain, recently surpassing OP Mainnet’s total TVL.

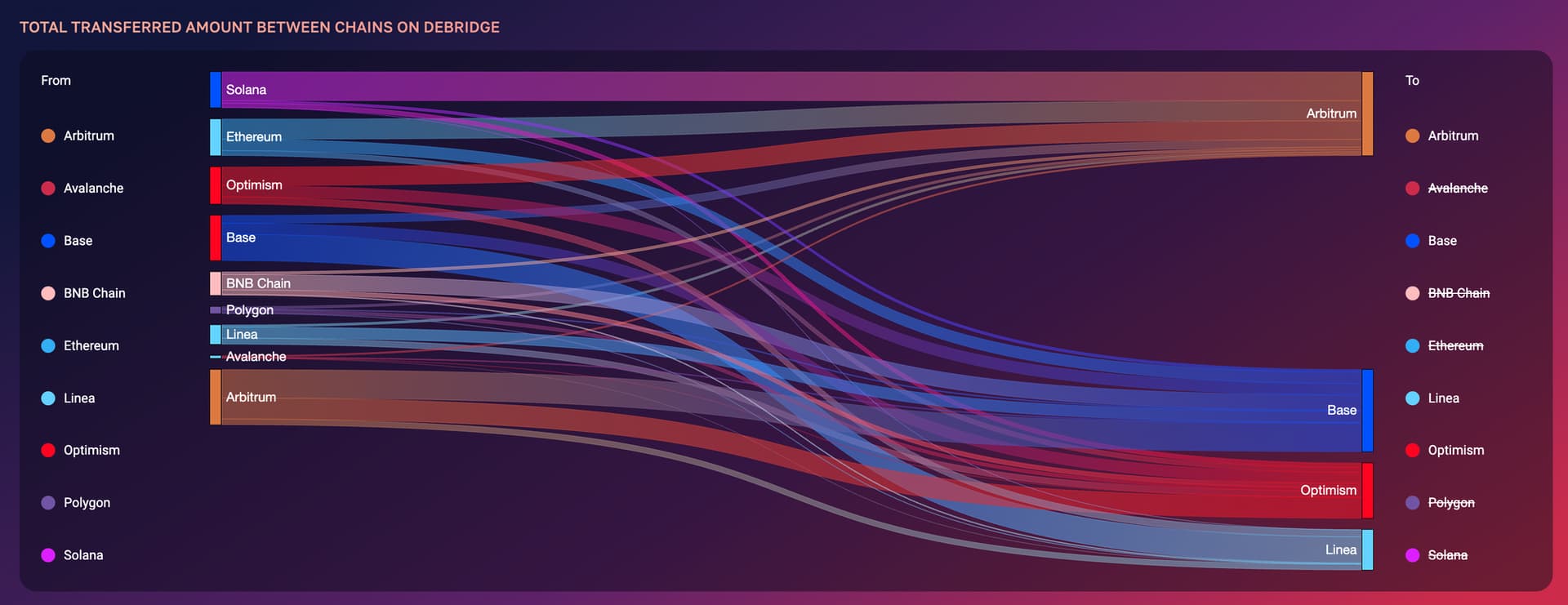

Base had a ~$1.5B USDC inflow since the beginning of March, with part of them being Coinbase moving customer and corporate funds onto Base. According to data from Artemis accounting across 11 major bridges sinc January 2024, there has been a $14 billion outflow from Ethereum to major L2s. Arbitrum leads with around $7 billion, followed closely by zkSync, Base, and OP Mainnet. Further data from Debridge Finance, a widely-used bridge among EVM chains and Solana, confirms that Arbitrum and Base are the top recipients of all the outflows.

The Bad: Amid Cheaper Gas, the Dark Forest Grows

When we further examine the transactions, we noticed that bot trading activities are elevating gas fees and revert rates on L2s. We will explore this issue more comprehensively in the next section through a case study using statistics on Base, highlighting the effects of cheaper gas on L2s after Dencun upgrade.

L2s Post-Dencun: Like The Pre-Flashbots Ethereum, Without a Mempool

Network Congestions

The challenges have begun to emerge: on March 26th, Base saw a short-term spike in daily average gas fees that surpassed even pre-Dencun levels. By June 3rd, Base had adjusted its gas target to 7.5M Gas/s, up from 2.5M Gas/s at the time of the Dencun upgrade, which brought the average gas cost back down to around 5 cents.

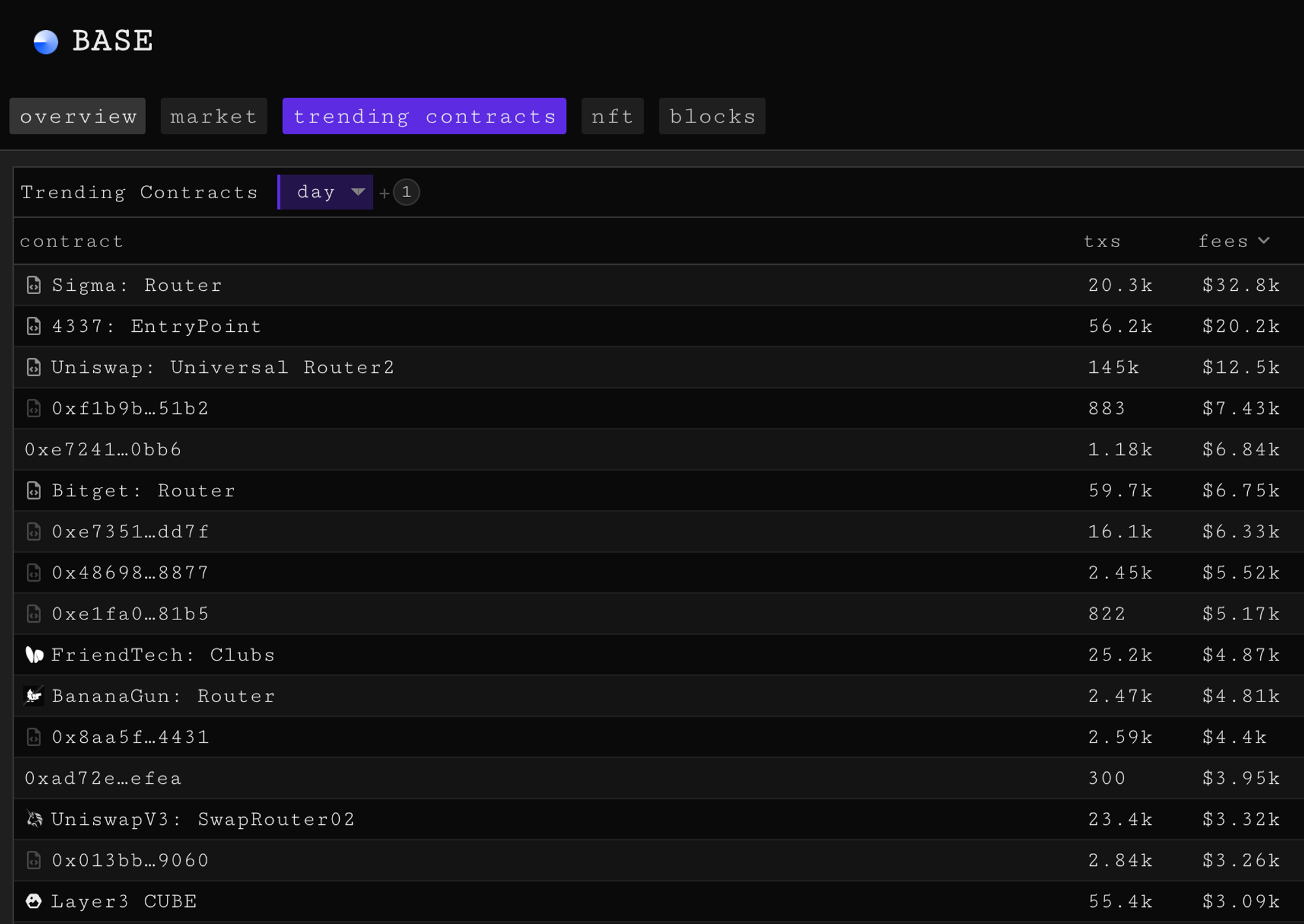

The top gas-consuming contracts on Base feature Telegram trading bots such as Sigma and Banana Gun, along with wallets and DEXs like Bitget and Uniswap. Additionally, a predominant number of unlabeled contracts are involved in activities such as token mints, memecoin trading, and atomic arbitrages.

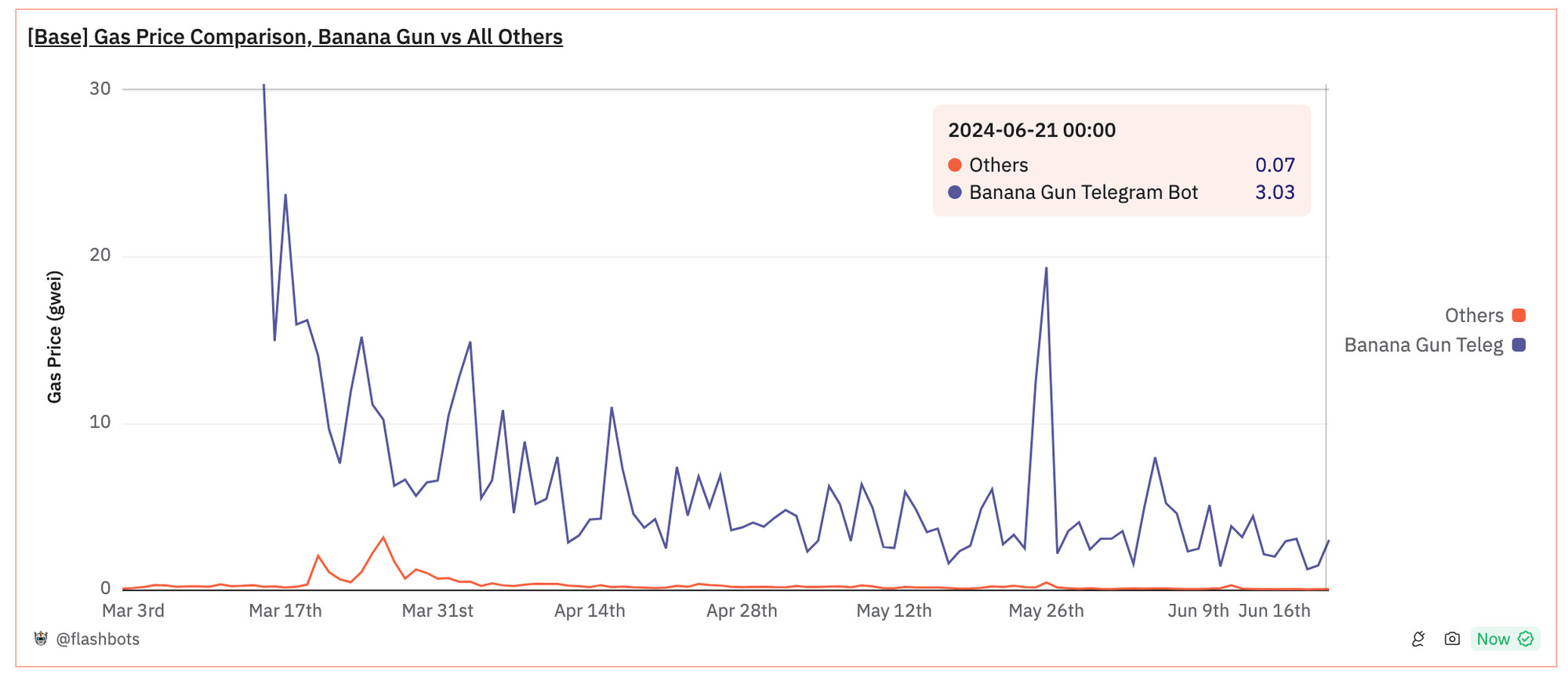

By comparing the behavior of popular Telegram Bot routers such as BananaGun, it is evident that their transactions incur significantly higher gas fees compared to other transactions. Following the upgrade, users of the BananaGun Telegram bots were paying a peak gas price of 30 Gwei to execute transactions on Base. This rate has since stabilized at around 3 Gwei, which remains 43 times higher than the gas fees paid for other transactions.

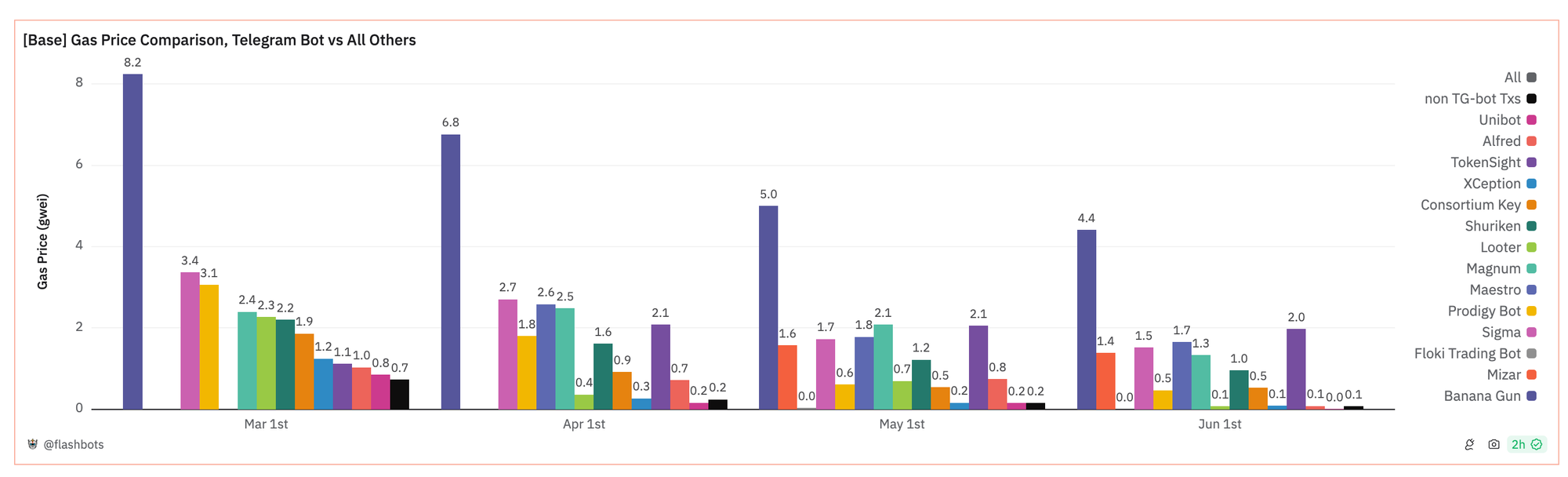

When analyzing the monthly average gas price paid by all the popular DEX trading bots on Base, and comparing it to all other non-Telegram-Bots transactions (black bar), it’s clear that trading bot users incur significantly higher gas costs.

High Revert Rate Spikes

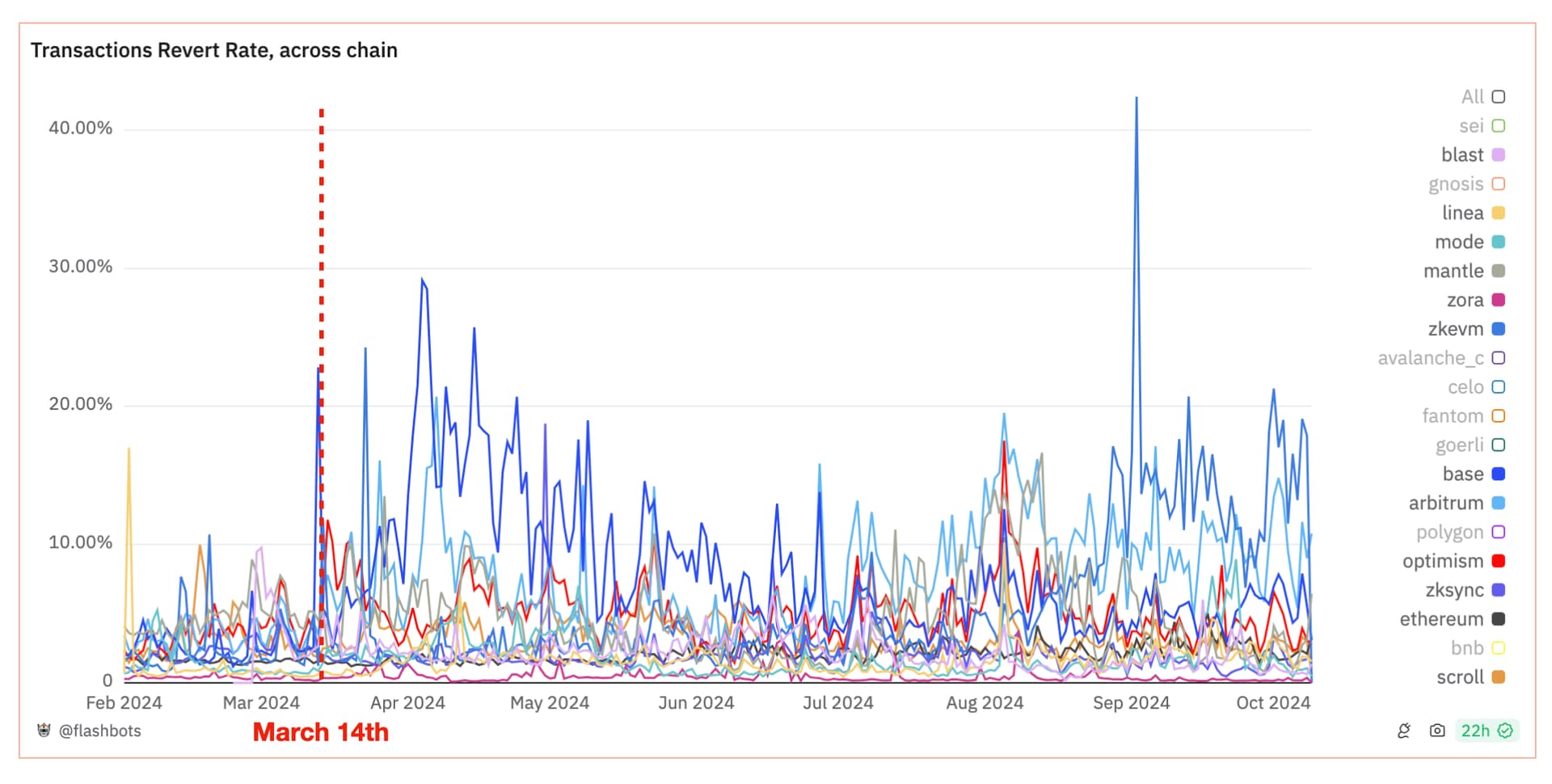

Another important measure for a blockchain is the transaction revert rate across the network, from which we also observed an increase for the L2s after Dencun upgrade — particularly on Base, Arbitrum and OP Mainnet.

Currently, Ethereum’s revert rate stands at approximately 2%, while Binance Smart Chain and Polygon have rates around 5-6%. Prior to the upgrade, the revert rate on Base was about 2%, but it has since spiked to around 15%, with a peak of 30% on April 4th. Similarly, Arbitrum and OP Mainnet have seen periodic spikes in failed transactions, ranging from 10% to 20%.

Digging deeper, we notice that the high revert rates on L2s do not necessarily reflect the experience of every regular user. Instead, these reverts are likely from MEV bots.

Using the heuristics below (query), we identified a set of router contracts with bot-alike activities — who appear to experience high revert rates, while performing MEV extraction trades:

Since Dencun Upgrade,

- Active Router: The contract has processed over 1,000 transactions.

- Limited Interacted EOAs: Fewer than 10 EOA (Externally Owned Accounts) wallets have interacted as transaction senders.

- Senders Distribution: Less than 50% of transaction senders have sent only one transaction, suggesting a user base that does not exhibit a long tail distribution. This indicates that the router is unlikely to be used by retail users.

- Behavioral Patterns: The transaction history either covers exactly 24 hours or shows more than one transaction within a single block, suggesting non-human behavior.

- Swap Concentration: Over 75% of its successful transactions involve a swap.

- Detected MEV Txs: More than 10% of successful transactions utilize atomic MEV strategies, as detected by hildobby’s heuristics.

Using these criteria, we detected 51 routers that likely represent a conservative estimate of the lower bound of bot activities on Base.

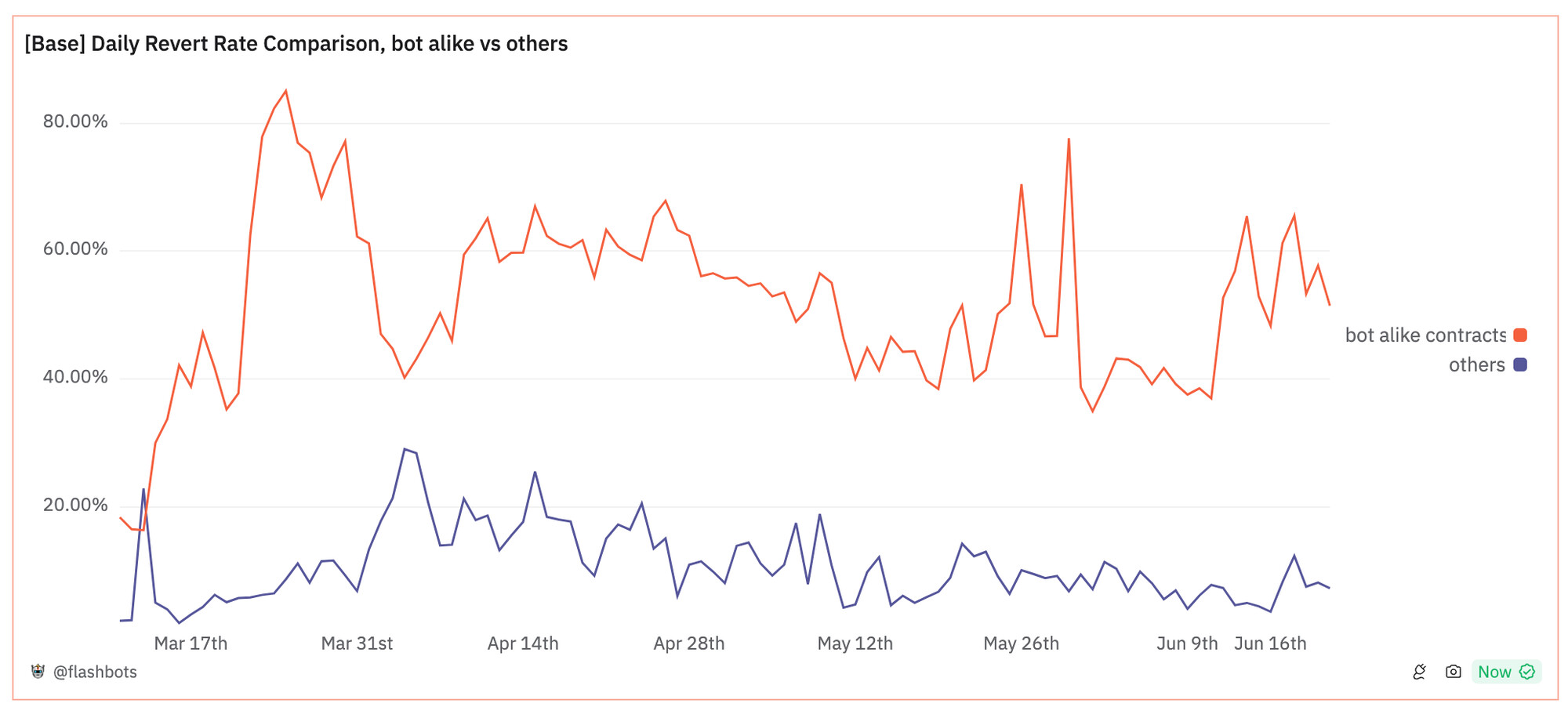

We divided all Base transactions processed by routers into two groups for analysis. The comparison of revert rates between the bot-alike routers and the rest is striking: bot-alike contracts exhibit an average revert rate of 60%, which is six times higher than the roughly 10% observed in the remaining transactions.

From the data above, we can conclude that bot activities, such as MEV bots and Telegram bots are likely one major reason of high gas fees and revert rate on Base.

The single-sequencer infrastructure of L2s, coupled with the absence of a public mempool, fosters dominant MEV strategies that involve heavy sequencer spamming. These strategies significantly contribute to network congestion, particularly on L2s that utilize Priority Gas Auctions (PGAs) like OP Mainnet and Base. The consequence is not only congested networks but also the waste of block space for reverted transactions and gas fees paid by MEV searchers. This scenario mirrors the pre-Flashbots state of Ethereum, with the notable exception that sandwiching MEV is absent on L2s due to the current lack of a mempool.

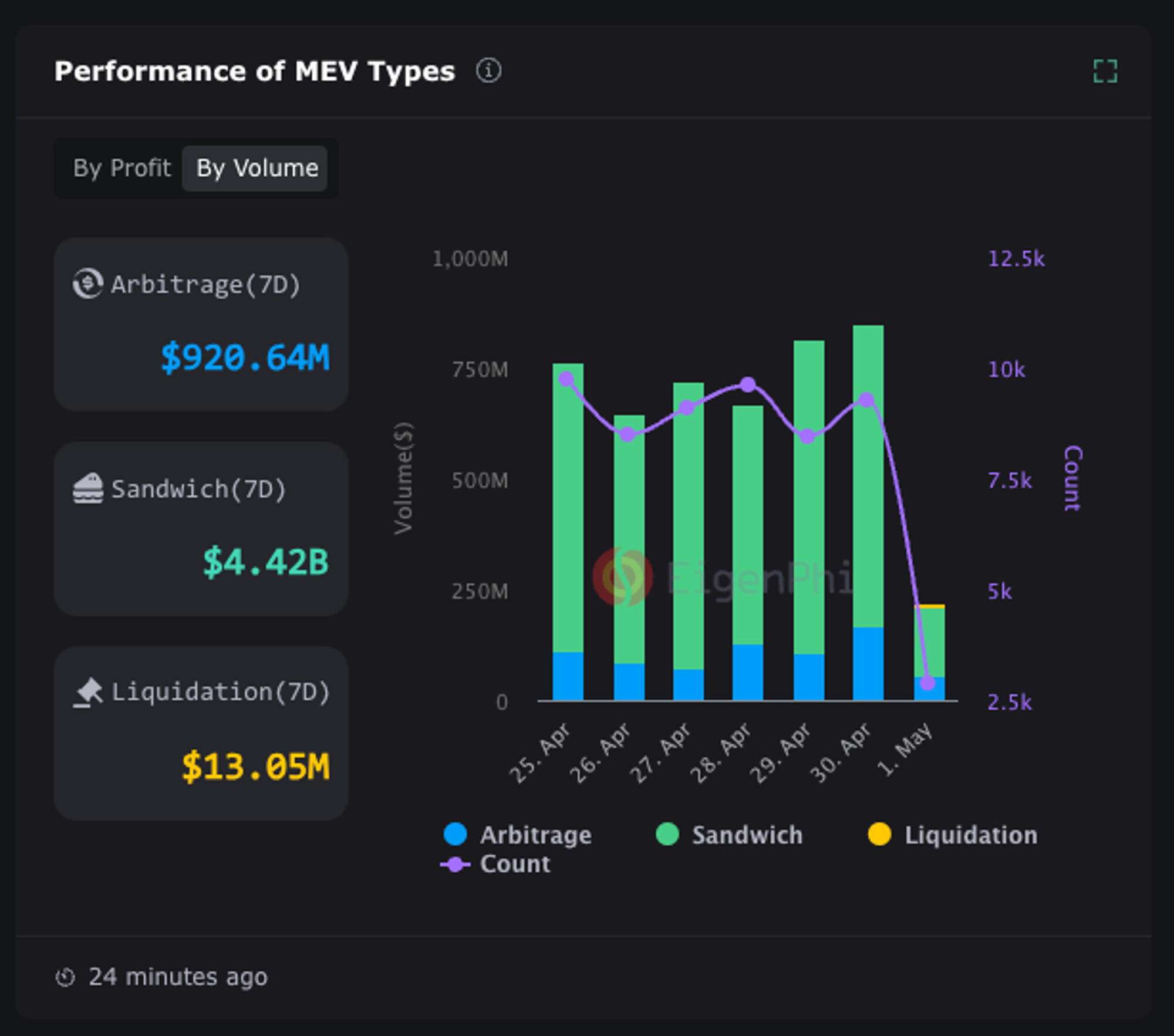

How big are MEV on L2s?

It’s crucial to gain a deeper understanding of MEV activities on L2s. However, so far, no agreed-upon numbers exist for L2 MEV, that are validated through multiple sources and robust methodologies. Moreover, there’s a lack of live monitoring data similar to works done for Ethereum (e.g. mev-inspect, libmev, eigenphi) for L2 MEV volume and searcher profits.

Some L2 MEV datasets and research published so far include:

- Open source dataset built by hildobby on Dune Analytics (heuristic links: Sandwiches | Atomic Arb)

- Research paper funded by Flashbots grant, Quantifying MEV On Layer 2 Networks by Arthur Bagourd, Luca Georges Francois, which quantified MEV on Polygon, OP Mainnet, and Arbitrum using a mev-inspect implementation.

- Research paper, Rolling in the Shadows: Analyzing the Extraction of MEV Across Layer-2 Rollups by Christof Ferreira Torres, Albin Mamuti, Ben Weintraub, Cristina Nita-Rotaru and Shweta Shinde, quantified activities and discussed novel MEV strategies on L2s leveraging the sequencer role and its L2 batch confirmation delay

Besides the resources above, Sorella Labs will soon be releasing their MEV data indexer tool Brontes, which will be an open source repository that can be used for both Ethereum mainnet and L2s. Flashbots and the Uniswap Foundation are looking to provide grants to expand L2 MEV taxonomy and quantification. If you have conducted work in this area or are interested in collaborating, please reach out to Flashbots market research team (@tesa on Telegram: @tesa_fb)!

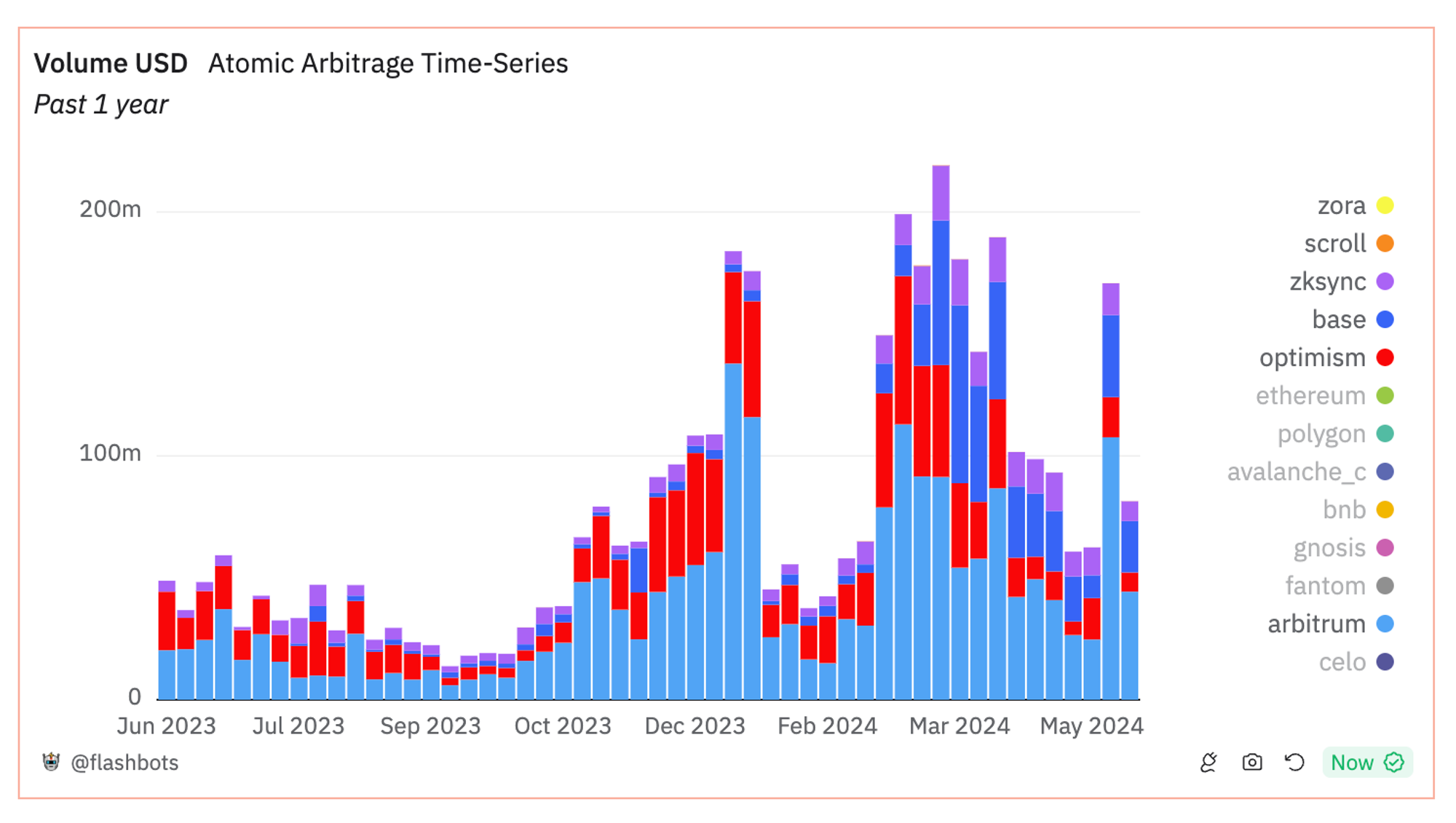

Although further validation is required, hildobby’s dataset on Dune Analytics serves as a valuable preliminary benchmark:

In the past year, there has been over $3.6 billion in Atomic Arbitrage MEV volume across six major L2s (Arbitrum, OP Mainnet, Base, Zora, Scroll, and zkSync) - which ranges from 1% to 6% of all DEX volume respectively on each chain. These MEV volume concentrated primarily on Arbitrum and OP Mainnet but has recently shifted towards Base and zkSync.

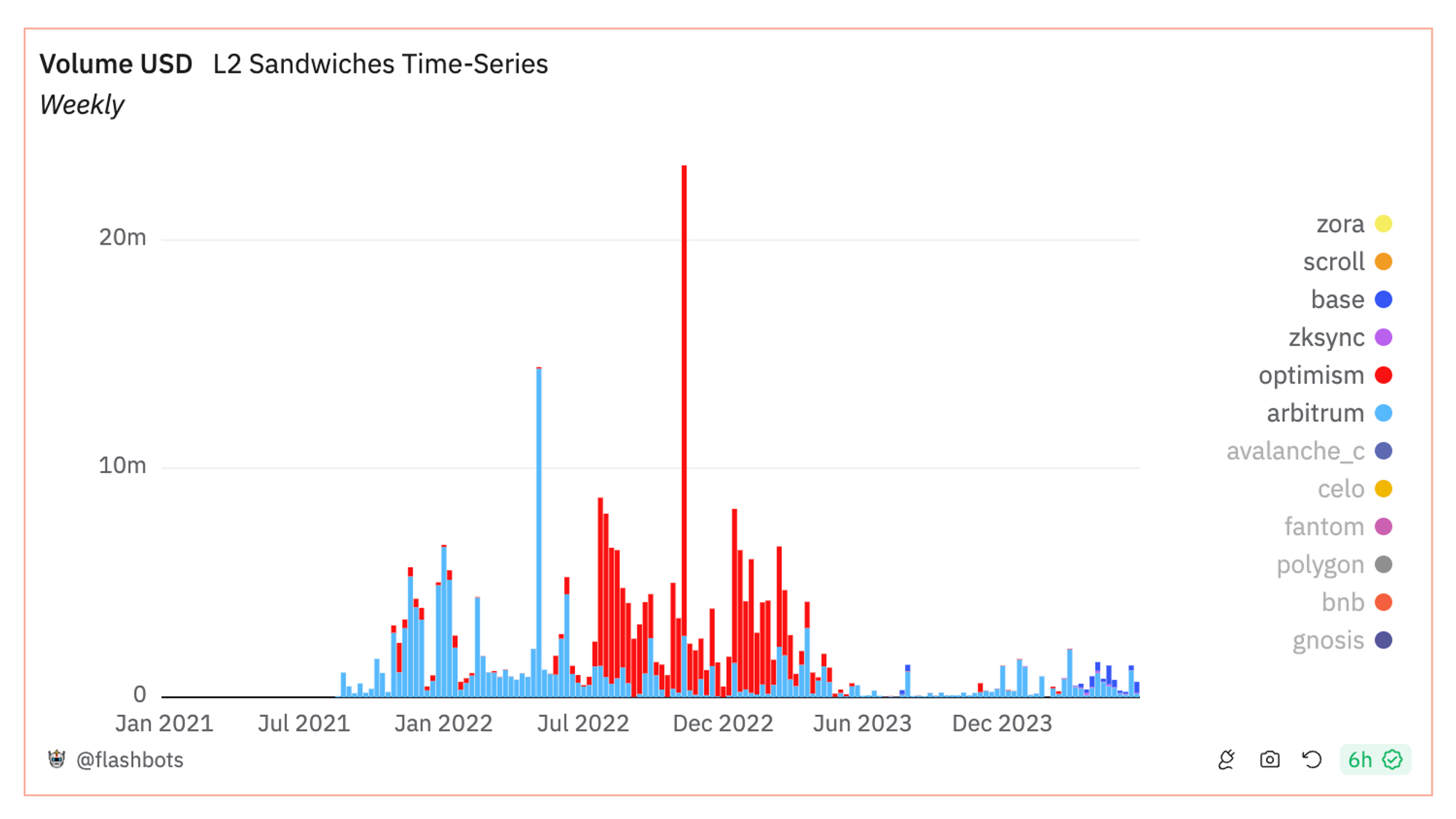

Sandwich volume across L2s is significantly lower compared to atomic arbitrage volume, contrasting sharply with the situation on Ethereum, where sandwich volume is four times higher than arbitrage volume. This discrepancy is due to single sequencer setup of L2s which by nature introduces no mempool, in which case, searchers will not be able to perform sandwich MEV with user’s transaction observed from the mempool (unless there is mempool leak or sandwiching from the single sequencer). Instead, strategies like atomic arb, blind backruns, statistic arbitrages and liquidations are the most feasible options for searchers on L2s.

Sizing the MEV Market

How Much MEV Revenue are Left on the Table for L2s?

While it is difficult to precisely quantify the MEV market, we can examine the numbers from other ecosystems with MEV solutions to draw a sizing comparison:

-

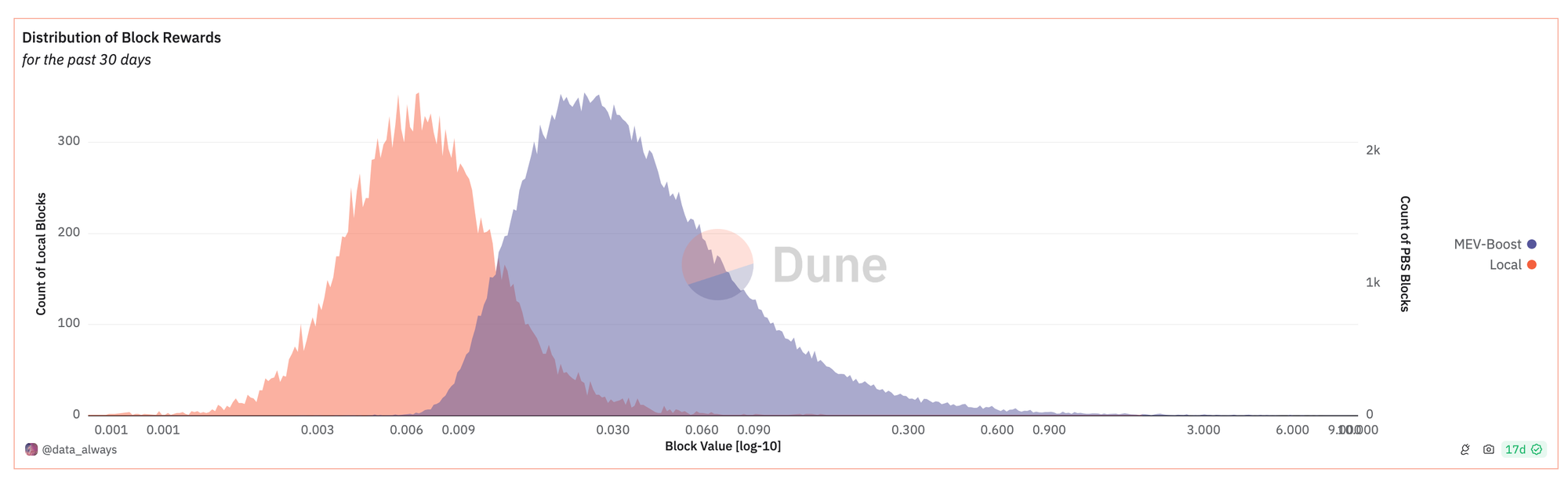

on Ethereum L1, the annual validator revenue from MEV-boost blocks is around $968 million (estimated using ETH price at $3500); and MEV-boost block’s median value is 4x than vanilla validator’s block value.

-

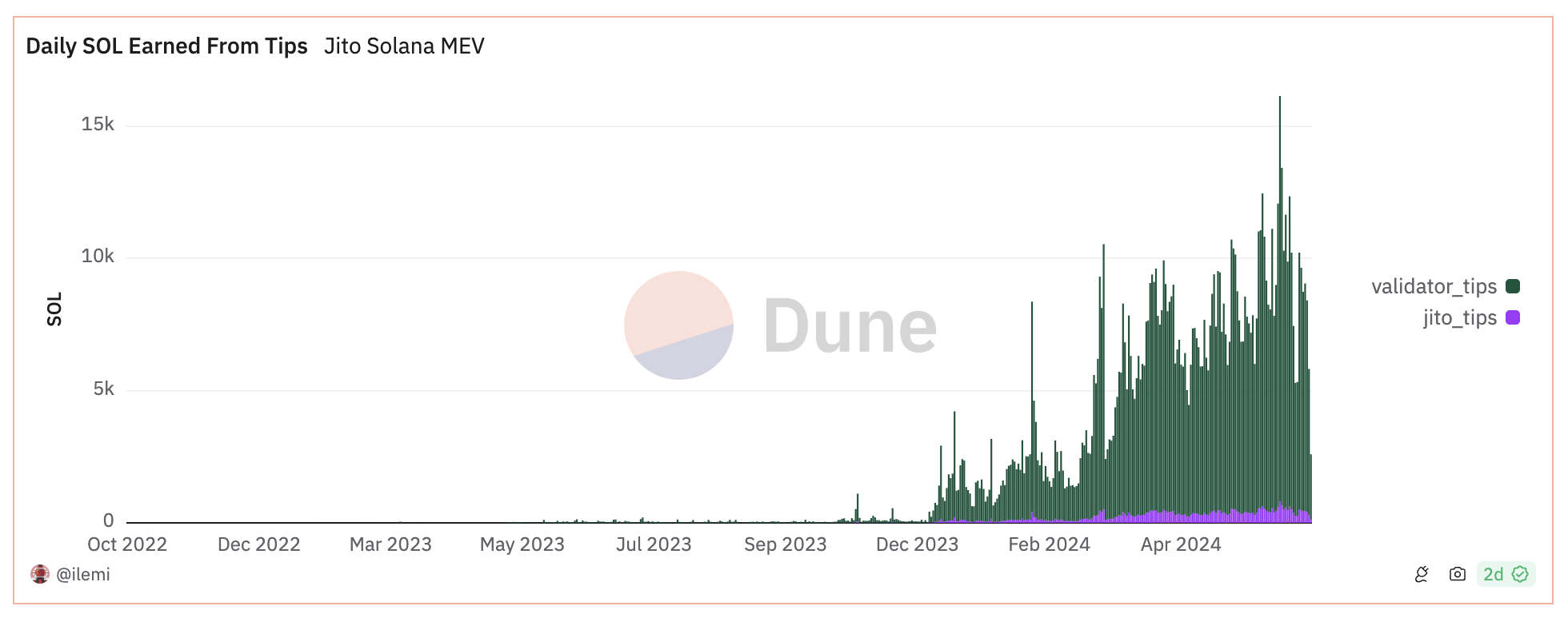

on Solana, validators’ extra MEV revenue collected from validator tips via Jito’s bundle services, projected based on 50k SOL per week, stands at about $338 million (estimated using SOL price at $130).

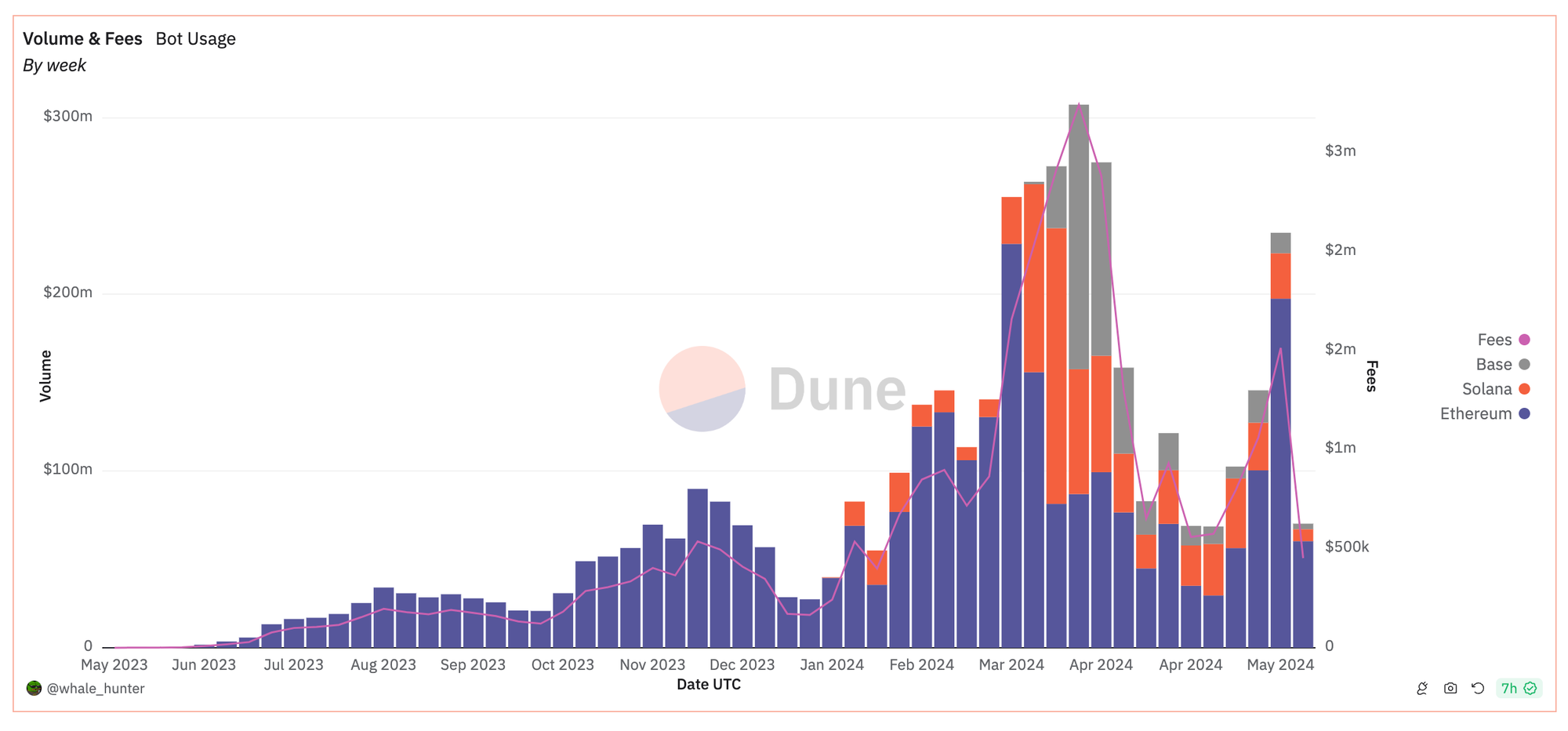

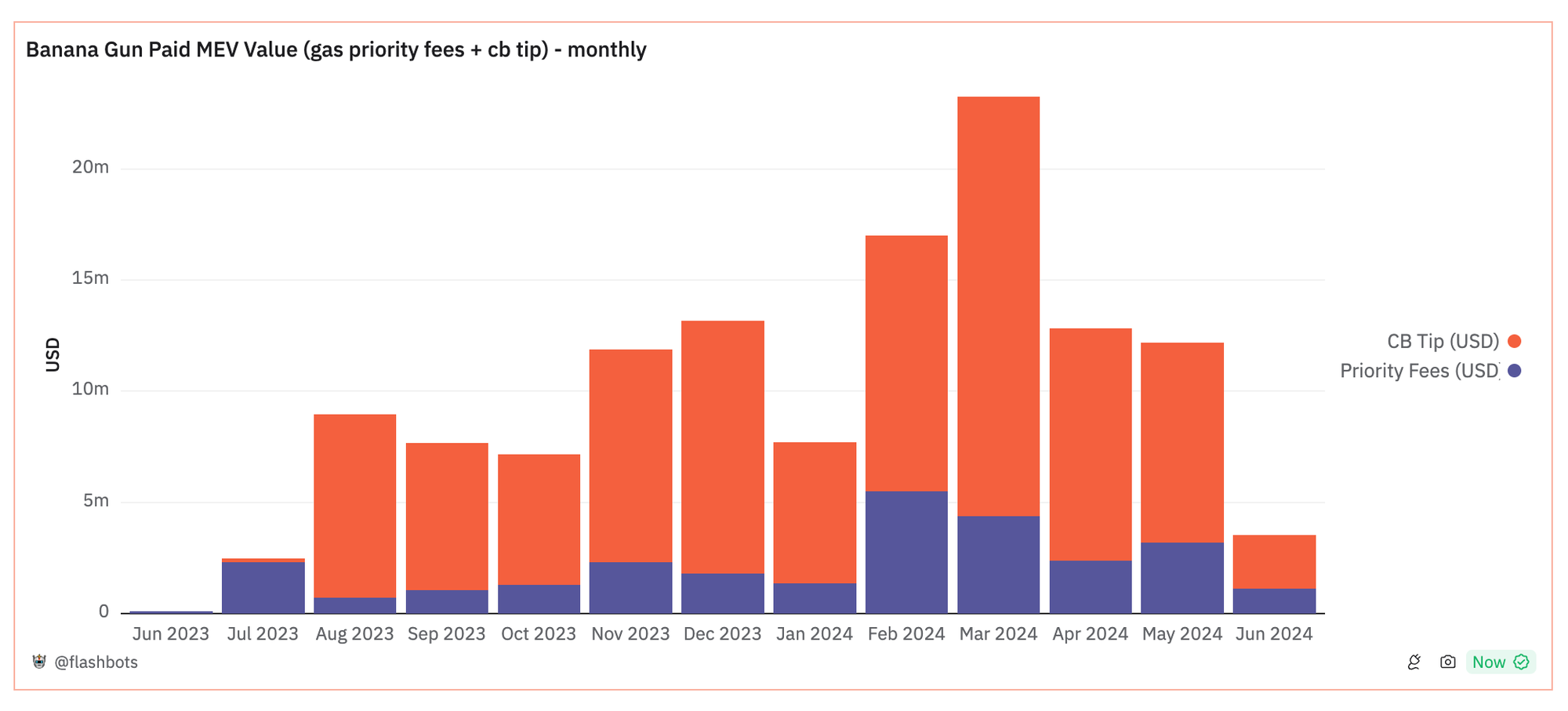

While exact figures for Base’s MEV volume are not available, an estimation of the market size can be made by analyzing the revenue from the Banana Gun Telegram Bot, one of the most active in this space. The bot’s volume on Base as a L2 is at par with its volume on Solana - consistently generating over $1 million in daily trading volume and consequently over $10,000 daily fees on each chain.

Note that there might be notable differences in the market share for the Banana Gun Bot on Solana versus Base. For example, Solana has several other major Telegram bots, such as Sol Trading Bot and BonkBot, while there are likely fewer Telegram bots supporting Base. Therefore, Banana Gun’s volume doesn’t translate to the total MEV revenue for Base in proportion of their Solana revenue ratio.

However, consider another projection using a different metrics: In March alone, the Banana Gun Telegram Bot paid over $23 million to Ethereum builders and validators! When comparing its volume across chains, its trading volume on Base actually surpassed Ethereum on the week of March 26th and April 1st (as the peak in the chart above), indicating significant MEV revenue potential on Base.

Certainly, the MEV ecosystems of Base and Ethereum are very different. MEV competition on Base is likely much less intense compared to Ethereum, meaning bots needing to bid less to validators. However, meme coin trading bots operate primarily through blind sniping and arbitraging, which remains feasible within Base’s sequencer setup.

Calling for MEV Attention

Ethereum has established a sophisticated MEV ecosystem with infrastructure toolings serving different layers of players in the supply chain. At the protocol level, MEV-boost allows validators to outsource the block-building process through auctions. For searchers, bundle services provided by Ethereum’s block builders, similar to Jito Labs on Solana and FastLanes on Polygon, enable searchers to propose MEV strategies with revert protection. These services ensure that builders simulate transactions and only process those that are non-reverting. Additionally, private RPC services like Flashbots Protect offer retail users a way to avoid public mempools and the associated risks of being sandwiched. L2s at their current forms still have considerable progress to make in developing a comparable MEV infrastructure.

Why shall we think about MEV solutions for L2s?

MEV still exists without a mempool. And MEV strategies such as Statistic Arbitrage(CEX-DEX arbitrage), Atomic Arbitrage (DEX-DEX arbitrage) and Liquidations serve a purpose in maintaining market efficiency by clearing stale liquidities in AMMs and Lending markets.

However, without mature MEV infrastructures like bundle services, there come negative externalities. Without a mempool, most MEV strategies default to spamming tactics, leading to:

- Increased revert rate across the networks;

- Elevated gas fees and therefore network congestion.

By introducing bundle services and offloading the pressure of MEV competition from onchain to sidecars, users can be exempt from suffering high gas fees raced by the MEV bots. Searchers can also benefit with higher profits from revert protection since the cost on failure can be reduced.

For L2s aiming to have shared sequencers, most solutions today will require users to commit their transaction to a public mempool, and in turn sandwiching will be reintroduced. That is when MEV protection solutions, like private RPCs that send user transaction directly to block builders like Flashbots Protect, can provide protection against sandwiches and even offer MEV or priority fee refunds to give users better execution and better prices.

However, there are still open challenges with more sophisticated MEV infrastructure. For one, the economics of searching changes and leads to lower marginal profit for searchers over time as more value is paid to sequencers. In turn this leads to a question of the sustainability of searching strategies that have a lot of competition in the long run. We expect market forces to play out here, where common searching strategies will pay most but not all of their value to sequencers, and less common searching strategies will need to pay less.

Furthermore, the orderflow dynamics of existing MEV infrastructure like Ethereum’s block building market are still rapidly evolving. At the time of writing, they are a large contributor to the centralization of block building markets and the rise of private mempools on Ethereum L1. How to ensure a competitive and fair block building market is still an open challenge.

Finally, the MEV solutions of L2s may also differ from the current on Ethereum, due to its unique attributes of faster block time, cheaper blockspace, and relatively more centralized governance. It is unclear if the fast block times, like Arbitrum’s 250ms blocks, are compatible with the current performance and requirements of existing MEV infrastructure. Moreover, the abundant and cheap blockspace that L2s offer changes the dynamics of searching sharply, which makes spam a more salient problem to solve and may require novel solutions. Finally, L2s are relatively more centralized than other settings, like Ethereum L1. In that context it might be permissible to enforce additional requirements on MEV service providers - e.g. requirement that block builders do not sandwich users - for fair market outcome.

As the final call-to-action to this post:

- We encourage researchers and teams to reach out and collaborate on research defining novel L2 MEV strategies and designing L2 MEV solutions. Please share discussion under this post or reference to this post to apply for Flashbots Research Proposal grants.

- We are looking for grantees to contribute on L2 MEV quantification & indexing tools and build taxonomy on the state of MEV on L2s. Please reach out to our market research team (@tesa on Telegram: @tesa_fb) to learn more about the L2 MEV grant details.

- As an effort of exploring L2 block building on SUAVE, we are looking for people to join a community call to discuss blind backrunning and its implications on sequencer design and throughput. Please reach out to @dmarz on Telegram (@dmarzz) if you would like to participate.