By Quintus Kilbourn and Conor McMenamin

This document compares two ends of a spectrum of auctions that can be used in proposer-builder separation auctions. These are slot (before value is known) auctions and just-in-time (JIT) auctions such as the well-known, relatively well-studied MEV-Boost (MB). While the discussion is Ethereum-centric, the post is meant to serve as a starting point for other chains like Eth L2s thinking through this decision.

Many thanks to Akaki Mamageishvili, @Christoph Schlegel, Michael Neuder, and Josh Bowen for their ferocious love of blockchain, great wisdom and eternal patience.

Assumptions: the article assumes familiarity with MEV-Boost and today’s market structure of relays, builders, users and searchers. The article also assumes that crlists (1, 2) are implementable at a reasonable timescale and so it does not deal with the implications of their absence in any scenario.

Early Auctions

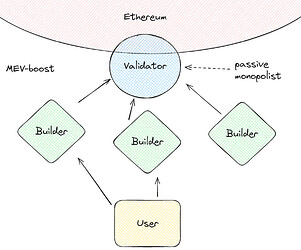

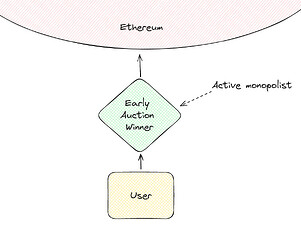

Let’s assume, in contrast to today’s PBS auctions which take place “just-in-time”, the protocol decided to sell the right to produce a slot’s block (absent the right to control crlists), in advance of a slot. Let’s call this an early auction to be explicit that it happens some significant time in advance of the slot. This places the winner in effectively the same role of the proposer as auctioneer in MEV-Boost, now able to conduct a “block auction”, with a few differences.

- The auctioneer no longer sits behind a commit-reveal scheme.

- The auctioneer now has much higher computational resources at their disposal.

- The identity of the auctioneer is not tied to Ethereum stake so it could be the same auctioneer at every slot.

- The auctioneer is able to sell preconfirmations ahead of the slot, although it’s not clear how these would be enforced outside of slashing.

- The revenue going to the Ethereum protocol (or its validators) is only indirectly related to the block auction.

Now we have two broad lines of questioning that we should go down. How do these changes impact users and how do these changes impact the protocol? In order to tackle these, we must first explore who is likely to participate in the early auction.

(Some articles refer to early auctions as we describe them as “slot auctions”. See the appendix for existing literature on this topic)

The Early-Auction Bidding Market

This section outlines some of the important factors which differentiate bidding strategies between early- and JiT-auctions. We expect the early-auction bidding market to have a smaller pool of bidders than the MEV-Boost market. The bidders are likely to be dominant CEX-DEX arbitrageurs such as Beaverbuild and Rsync.

Information

JiT auctions like MEV-Boost provide builders with the ability to only pay for opportunities when their speciality pays off. For instance, some builders may prefer times of high price volatility for certain assets while others may care about specific smart contracts being used. This makes infrequently valuable strategies viable, creating a larger, somewhat diverse builder market.

In contrast, early auctions reward builders that perform well on average. The further in advance an auction is run, the less information there is available about the slot and its value to different bidders. In the limit, this means that all slots being auctioned off are almost indistinguishable at the time of auction, leading to the builder with the strategy that yields the highest expected revenue winning almost every auction. This likely reduces the number of bidders to the one or two entities with the highest average expected return.

Risk

JIT auctions allow for bids to be placed when the block value is known with high confidence. Thus, JiT auction bidding is a low-risk endeavor.

Early auctions introduce greater risk-of-return and risk-of-ruin due to uncertainty of returns at the time of bidding. This should lead to discounted bids from rational players. This excludes small/risk-averse rational builders who cannot handle variance of payoffs, favoring entities who are good at risk management.

Capital Requirements

MEV-Boost currently allows builders to pay their bid atomically with receiving payments from other parties. This reduces the amount of capital a builder requires. Requiring the winning slot bid to be paid upfront increases capital requirements, raising barriers to entry.

It must be said that some JiT auction implementations such as several enshrined PBS designs may impose this capital requirement.

The factors above point to a small number of bidders in an early auction, bidders who have access to capital and can manage risk well. These factors suggest a profile like that of statistical arbitrageurs who, as the MEV-Boost market thus far has shown, also significantly benefit from integration. This point is more speculative and isn’t core to the arguments which follow.

Impact on Protocol

We assume the protocol cares about revenue, liveness, trust assumptions and market neutrality. There is little to say about liveness since we don’t have specific consensus implementations in mind and assume the existence of crlists in both auctions so this topic is omitted. Market neutrality is left to the user-focused section.

Trust assumptions

If early auctions are run sufficiently far in advance, they could in principle be done without the need for a trusted relay through the use of a commit reveal scheme. Depending on how the outcome of the early auction is enforced, relays in the block auction following the early auction could also be obviated, meaning that the early auction winner is the only trusted party for users.

Revenue

As less information is available during an early auction, revenue variance between blocks should be much lower. This has a desirable impact on the reward distribution among validators, although MEV-burn, MEV-smoothing and (partly) staking pools also achieve this. The more interesting question is what the impact on expected value of the revenue will be.

Several factors suggest that auction revenue will be lower for early auctions:

- Competition: if earlier auctions do support a smaller number of bidders (as argued above), auction revenue should decrease as a consequence.

- Risk: since early auctions require bidders to take on more risk, bids should be shaded down to account for this.

- Information: the earlier an auction is run, the less bidders know about the opportunity that is on offer (e.g. volatility or available transaction flow during the slot). Lower information leads to lower expected auction revenue. For a more detailed explanation:

- Assume each builder in a set of builders has a known distribution of values for a particular block building opportunity. Early auction winners have the maximum expectancy of the set of distributions (maximum average value).

JIT winners have the maximum of the values drawn from each of the distributions. In terms of expected revenue, this is the expected value of the maximum value drawn from each distribution (see this explanation of a generalized version of this scenario).

However, auction revenue is also impacted by changes in market structure which are somewhat harder to reason about. The next section elaborates more on these changes in market structure, but the overarching question is how much additional value an active auctioneer could extract in the block auction from things like monopoly pricing, cutting out middlemen and selling preconfirmations?

Impact on Users

Early auctions allow agents who are most able to squeeze out value from the block auction to become the block auctioneers. While these auctioneers could utilise auction designs such as MEV-Boost their willingness to take on technical complexity and expected desire to optimise their own trading platform likely shifts their preference to a market structure in which the auctioneer has more control and is more trusted (reminiscent of mev-geth).

This can be both great for users through the offerings of features like preconfirmations and harmful for users as sophisticated auctioneers are able to wield their monopoly power.

Monopoly pricing and execution quality

The status quo under MEV-Boost features a passive monopolist (the proposer) and a market of block builders who aggregate flows they receive from different sources, often on the back of trusted relationships. Users (both sophisticated and “retail”) and their proxies (like wallets) find themselves in a complex position of having to reason through multiple RPC endpoints, each with its own trust assumptions. The upside to this is that if a builder misbehaves users are able to send their flow to their competitors and still have a reasonable chance of being included in the next block. Thus builders are incentivised not to abuse the flow they receive (e.g. by frontrunning) so as to continue receiving this flow and remain competitive with other builders.

Under a regime which features early auctions, the active auctioneer cannot be circumvented and is thus able to do things like establish minimum tips that transactions have to pay to be included in their block(s) (monopoly pricing) and frontrun time-sensitive flow with little concern for recourse. Of course, this is a simplification as some users will be able to withhold flow if it is the case that other auctioneers have a slot coming up soon. This kind of withholding may also impact the winners of early auctions over time. The exact dynamics which play out are very hard to predict or reason about and should be carefully considered before implementing an early auction.

Users opting into a platform like SUAVE to collectively negotiate better execution is a possible response to such a situation, but the lack of competitive dynamics make the path to such an equilibrium unclear and may require the chain to require SUAVE participation from early auction winners.

Note the distinction between active and passive monopolists doesn’t hold in a rational model. This distinction is derived moreso from observed behaviour from validators. It may be that in the long run, validators approach the rational behaviour of being active monopolists anyway. On the other hand, exogenous reputation concerns may prevent this.

Preconfirmations

Early auctions have been marketed as allowing winning bidders to sell weak (unenforceable) preconfirmations (1,2) in advance. Apart from being potentially useful for UX, these may be desirable/necessary for certain use-cases. Such use-cases include atomic cross-chain transactions between unsynchronised blockchains. or as a means to buy insurance for blockchain participants who need periodic guarantees of blockspace access. Insurance buyers could include L2s, oracles, and periodic-batching protocols such as CoWSwap, who may be willing to pay premiums for such predictability. An emergence of insurance buyers would change our revenue analysis, although we don’t include such analysis here for complexity reasons.

However, the ability to preconfirm may not be fully unique to early auctions. For example, the blockchain protocol could sell inclusion preconfirmation, albeit with greater latency, while still running a JiT auction in a PEPC-like way. The design space and implications of preconfirmations are underexplored. In particular, those touting this benefit must provide some way of distinguishing between a withheld preconfirmed transaction and a censored one. Without more concrete suggested designs it is hard to assess the value that early auctions offer over what other constructions can provide.

Conclusion

Early auctions are likely to be won by a very small set of parties who will find themselves in the position of a monopolist, capable of extracting rents. Two of the main benefits of early auctions are preconfirmations and reward-smoothing. It is not clear how much more valuable these benefits are in early auctions compared to JiT auctions, where those benefits may also be possible.

Appendix

Existing Work on Early Auctions

- Block vs. Slot Auction PBS - Julian Ma.

- Slot Auctions - Alana Levin.

- Parachain Slot auctions - @dmarz.

- Interchain Scheduler - Informal Systems.

Latency races

JIT provides builders with the ability to only pay for opportunities when their speciality pays off. This makes it cheaper to invest in infrequently valuable strategies, creating a larger, somewhat diverse builder market. However, this also has the effect of incentivizing low-latency optimisations that allow builders to submit bids at the latest possible instant.

To illustrate this incentive, consider an auction to build a block at time T. The value of the opportunity changes significantly less between T-20s and T-19s (early auction), as opposed to T-1s and T (JIT).

A market structure in which competition is mainly along the lines of latency can be seen as undesirable as investment in lowering latency is seen as wasteful and latency competition lifts the barriers to entry, concentrating the market.