The Geography of Block Building

Data Always - Flashbots

Special thanks to Quintus, Danning, Hasu, Christoph, and Burak for review and discussions of various drafts of this work.

tl;dr

Network latency has become an important axis of competition in PBS. At the relay level, timing games have driven relays to deploy instances in multiple geographies—positioning themselves closer to proposers, while opening new optimal paths for information flow. Meanwhile, the maturation of technical infrastructure has increased the payoff for builders who colocate with relays. Builders with transcontinental latency are no longer able to win auctions without exclusive order flow.

Trustless payments in ePBS offer a potential reset of market structure, but the future remains uncertain. If relays are disintermediated the incentive for geographic chokepoints in the MEV supply chain will be reduced, but if proposers choose to keep using relays then centralization pressure will continue to build.

In March, we showed that PBS auctions have become significantly faster and that minimizing builder–relay latency is now an important competitive advantage for top builders. We further showed that as a byproduct of falling latency, builders have been able to reduce their bid increments, transforming the traditional first-price auction at relays into essentially a second-price auction. Throughout 2025 the trend has continued: at Ultrasound relay, median bid turnover at auction peak fell from 20 ms (Q4 2024) to 13 ms (July 2025). As the adoption of Optimistic V3 relaying grows, we expect auctions to continue accelerating.

However, despite the increasing significance of latency, exclusive order flow remains the most important feature for predicting which block builder wins an auction. But when we step outside of blocks with a clear winner, the majority of value comes from transactions shared with many builders. In these auctions, competition drives profit expectations near zero for all but the lowest latency bidder—exerting strong centralization pressure on the builder set.

The goal of this article is to use public data to examine the geographic strategy of block builders, to determine whether the incentives to minimize latency have driven changes in MEV market structure, and to characterize the advantage gained by colocated builders.

Relays Shape the Geography of the MEV Supply Chain

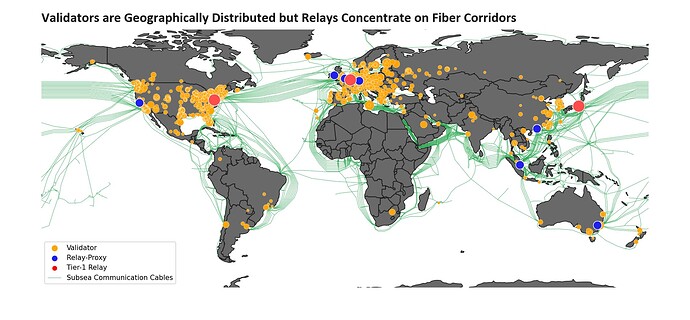

A natural starting point when discussing the geographic distribution and colocation incentives of actors in the PBS ecosystem is validators. Often seen as the backbone of the Ethereum Network, the geographic decentralization of the validator set has been the focus of extensive modeling by Chainbound and the Ethereum Foundation (Figure 1). This decentralization provides effective censorship resistance for transactions and supports network liveness, but only when proposers choose to build their own blocks. When proposers outsource sequencing through PBS, they inherit jurisdictional limitations from both relays and builders.

In stark contrast to validators, relays have historically been deployed in two major locations: the eastern United States and France. By design, proposers and builders can only interface through relays; this incentivizes block builders to optimize their pipelines for low latency to these two regions. In effect, block builders are tethered to these chokepoints in the MEV supply chain.

Figure 1: the geographic distribution of Ethereum validators with the locations of major relays and relay proxies superimposed. Relays and proxies are concentrated at hubs with fast intercontinental distribution, while validators remain geographically decentralized.

By choosing locations attached to fast transatlantic fiber, relays attempted to serve both North American and European validators. However, as market structure has matured, the efficacy of this approach is being called into question. Most relays now intelligently delay their getHeader responses to deliver the best possible bid just-in-time; as a result, every millisecond has become valuable. Even on fast fiber, crossing the Atlantic incurs approximately 40 milliseconds of network latency—equivalent to three top-bid updates in the median case, and significantly more during highly competitive auctions.

| France | North Virginia | Oregon | Japan | |

|---|---|---|---|---|

| France | — | 38 ms | 66 ms | 111 ms |

| North Virginia | 38 ms | — | 28 ms | 73 ms |

| Oregon | 66 ms | 28 ms | — | 45 ms |

| Japan | 111 ms | 73 ms | 45 ms | — |

Table 1: median AWS data center to data center latency for selected locations.

Source: Google Cloud PerfKit; data for July 1 to August 31, 2025.

Competition among relays to reduce proposer–relay latency has spurred efforts to distribute relay infrastructure. The first mover was bloXroute, which launched its Validator Gateway and relay proxies—tools that act as forwarding points, with top bids from bloXroute’s auction in North Virginia constantly pushed to mirrors across the world. Titan and Ultrasound have gone a step further by launching additional full relay instances, and now have coverage on both sides of the transatlantic fiber corridor, as well as in Japan.

The importance of performant relays in Japan should not be understated. Proposers located in Asia have traditionally suffered from exceptionally high proposer–relay latency; encouraging the clustering of validators on either side of the Atlantic Ocean. These new instances meaningfully reduce geographic centralization pressure on the validator set.

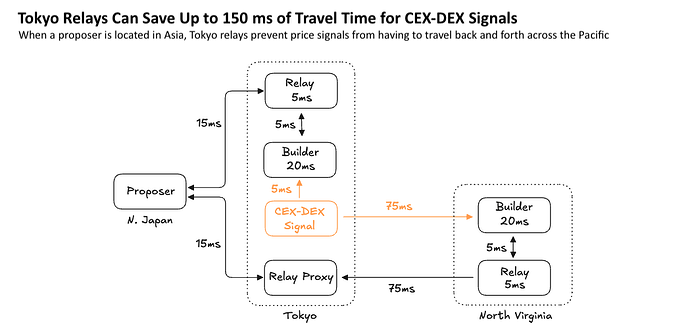

During slots where the proposer is located in East Asia, Japanese relays enable more direct information flow and grant a large advantage to searchers performing non-atomic arbitrage using Binance price signals. As seen in Figure 2, searchers incorporating price signals from Asian centralized exchanges incur a latency penalty of approximately 150 milliseconds by sending order flow to builders participating in an auction in North Virginia. Because these price signals are the most latency-sensitive class of order flow, American and European relays are now relatively uncompetitive during these slots.

Figure 2: the path of information flow for a CEX-DEX signal originating in Tokyo when the block proposer is also located in Japan. Although a relay proxy minimizes the last leg of travel time between the proposer and a North American relay, the additional ~150 ms of latency from crossing the Pacific Ocean twice gives Asian relays a competitive advantage.

Builder–Relay Latency Effects in Auction Data

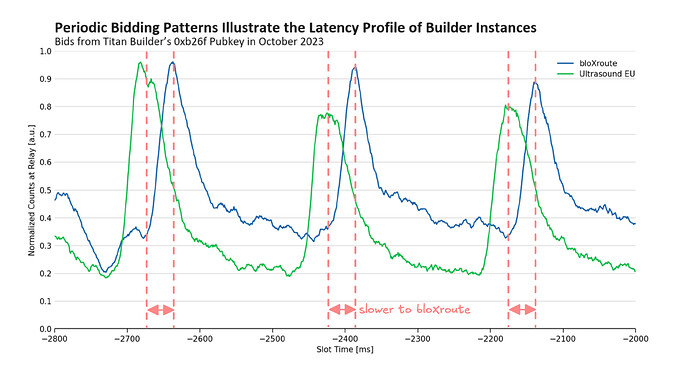

Our previous analysis noted that some block builders used periodic bidding strategies in the early days of PBS; specifically, we showed that Titan Builder was submitting bids to Ultrasound relay every 250 milliseconds in fall 2023. If we shift our focus from many builder instances at Ultrasound and instead isolate a single public key that bids at multiple relays, we can infer geographic properties about a single builder instance.

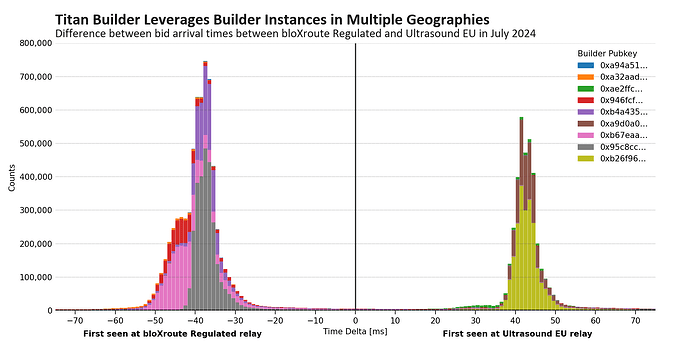

In Figure 3, we isolate bid submissions from the 0xb26f public key and compare the profile at Ultrasound’s European relay against a normalized profile at bloXroute’s two relays in the eastern United States. The density peaks are consistently earlier at Ultrasound relay, suggesting that the propagation time from the builder instance to bloXroute was measurably longer.

Figure 3: a cutout of bid arrival times for one of Titan’s builder instances in October 2023. During this period of time, the instance was bidding at fixed 250 ms intervals, allowing us to infer the difference in propagation time to geographically distant relays. We see that bids for the 0xb26f pubkey tended to arrive about 40 ms earlier at Ultrasound’s European relay relative to bloXroute’s relays in North Virginia.

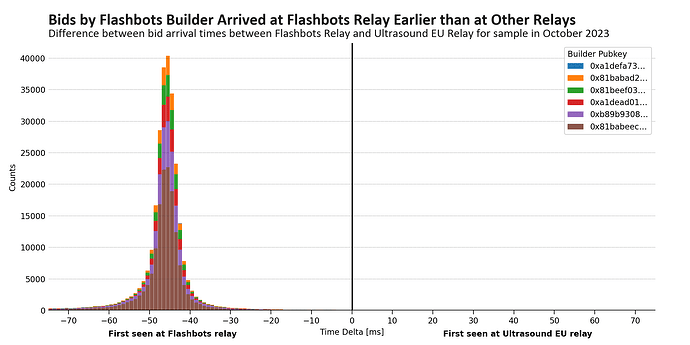

We started with periodic bid submissions to build intuition around propagation times, but most bidding isn’t predictable. To gather a more robust sample, we can go a step further and match bids by block hash and public key across relays. By taking aggregates of the difference in bid arrival timestamps from these matching bids, we can infer the latency profile and likely location of a builder instance.

Since Flashbots operated both a builder and a relay in 2023, we can use the Flashbots Builder as a canonical example. Aggregating the data in Figure 4, the median bid submitted by the Flashbots Builder to both the Flashbots Relay (North Virginia) and the Ultrasound Relay (France) arrived 47 milliseconds earlier at the Flashbots Relay. Excluding the fastest and slowest 10% of bids, the remaining 80% arrived 42–66 milliseconds earlier. This aligns with our expectations from the AWS data in Table 1 for how transatlantic bidding should appear in the data.

Figure 4: the difference in bid arrival times for matching transaction hashes submitted by the Flashbots Builder to Flashbots Relay and Ultrasound’s European relay in October 2023. We see that bids from the Flashbots Builder arrived significantly earlier to the Flashbots Relay during this period.

Reduced latency is only one factor; however, the Flashbots Builder’s highest win rate came from blocks submitted to the Flashbots Relay. This is not an outlier: historically we saw the same dynamic with both bloXroute and Blocknative, and today we see similar effects with Titan.

Running the same analysis on Titan Builder—this time with data from July 2024, we see in Figure 5 that the distribution for the 0xb26f builder instance matches our earlier intuition, with bids arriving earlier at the Ultrasound Relay’s European auction. However, in this case we also see a mirror of bids that arrive earlier at bloXroute’s relay in North Virginia. This demonstrates that Titan ran builder instances in different jurisdictions, allowing it to be more competitive in auctions across multiple geographies.

Figure 5: the difference in bid arrival times for matching transaction hashes submitted by Titan Builder to bloXroute Regulated in North Virginia and Ultrasound’s European relay in July 2024. We see at least two distinct groups of time differences, reflecting builders in at least two distinct geographies.

How Big of an Advantage is Builder–Relay Colocation?

In the early days of PBS, block builders retrieved real-time auction information by mimicking a proposer and querying a relay’s getHeader endpoint. To this day, some relays still serve real-time auction data only through this endpoint, but most have shifted to a top-bid WebSocket model that continuously pushes data to connected builders. These WebSockets lower information latency for builders while also reducing the load on relays.

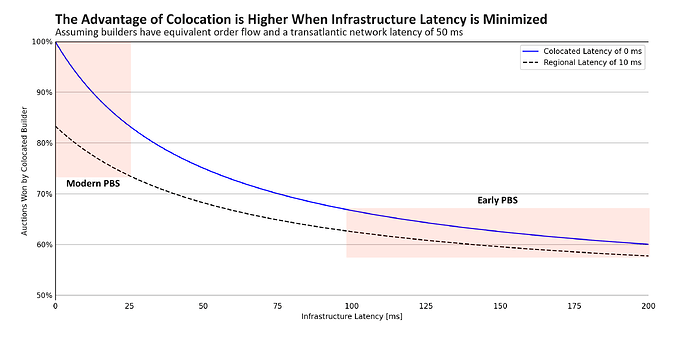

Block builders listen to these data feeds and respond as quickly as possible to outbid competitors. The speed of their response depends on two types of latency: network and infrastructure. Network latency is the packet travel time in either direction between the builder and the relay, and infrastructure latency is the time for a builder to prepare and transmit a new block, as well as for the relay to process an incoming bid and update the top-bid feed. When modeling the advantage of colocating a block builder at the relay, and thus reducing network latency near zero, the magnitude of infrastructure latency is a crucial, e.g., if it took a minute for a builder to construct a block, the value added by reducing your packet travel time by a few milliseconds would be negligible.

Using values from Frontier Research that predate optimistic relaying, we model in Table 2 an auction between two builders with equivalent hardware and order flow, with one builder located in the same region as the relay and the other submitting bids transatlantically. We assume builders take 50 milliseconds to generate new blocks and relays take 140 milliseconds to process and broadcast new bids. With this parametrization, the auction remains quite fair: the regional builder wins 58% of the time.

| Regional Builder | Transatlantic Builder | |

|---|---|---|

| Relay to Builder Latency | 10 ms | 50 ms |

| Builder Infrastructure | 50 ms | 50 ms |

| Builder to Relay Latency | 10 ms | 50 ms |

| Relay Infrastructure | 140 ms | 140 ms |

| Result: E2E Latency | 210 ms | 290 ms |

| Result: Win Probability | 58% | 42% |

Table 2: example end-to-end latency for a regional v.s. a transatlantic block builder in the early days of PBS. Assuming that the builders have equivalent order flow, the regional builder should win approximately 58% of the auctions.

However, over the past two years we’ve seen a continual push for faster speeds on all axes. The values in Table 2 are not reflective of state-of-the-art infrastructure today. Every new infrastructure optimization increases the competitive advantage associated with minimizing network latency. Although being in the same region as a relay was only a modest advantage two years ago, today (as shown in Figure 6) it is a necessity for operating profitably.

Figure 6: the impact of infrastructure latency (block building time, relay processing time, etc.) on the advantage gained by colocating a builder with the relay. In the early days of PBS, before optimistic relaying and when block building algorithms and infrastructure were slower, the advantage of colocating a builder was marginal; however, now that infrastructure has been optimized on all fronts, the value add of colocation has grown substantially.

How Colocation Incentives Impact Market Structure

The growing importance of builder–relay latency minimization has broad implications for PBS market structure. Historically, builders benefited from sending bids to all relays, but the rising importance of fast bid cancellations has made the risk of stale bids higher than the benefit of wide distribution.

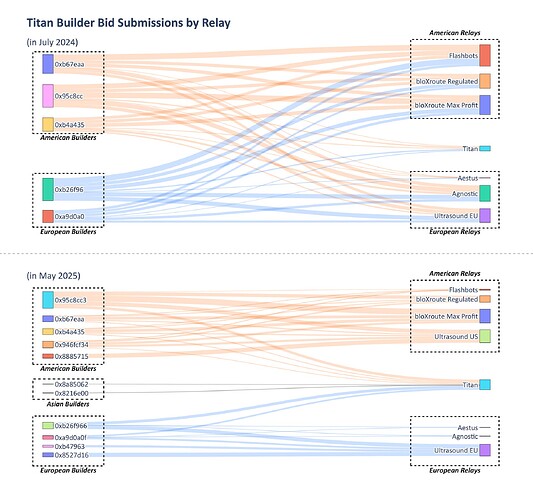

In Figure 7, we highlight how builder behavior has changed over the past two years. We focus on Titan Builder because it has been the only consistent top builder throughout the period. Between July 2024 and May 2025, we see a shift in strategy: Titan stopped sending bids across the Atlantic and now uses only relays in the same geography as the builder instance. To be clear, this is not unique to Titan; all builders that cater to latency-sensitive order flow must prioritize the ability to quickly cancel bids, which necessitates low builder–relay latency and makes transcontinental bidding untenable in the current market.

Figure 7: the evolution of bid submission strategies for Titan Builder. We see that in July 2024, Titan was submitting bids from all builders to all relays, independent of their respective geographies. However, by May 2025, Titan had shifted strategies and now only submits bids to relays geographically close to their builder instances.

Beyond network latency, the impact goes a level deeper. The importance of fast cancellations has dramatically reduced the marginal benefit of having the best bid at slower relays, even if they’re in the same region as the builder instance. This has bifurcated the market into two tiers of relays.

Two years ago, over 50% of blocks were relayed by at least one of Agnostic or Flashbots, but as both relays have held off on technical upgrades, their combined block deliveries have fallen by roughly 80% compared to October 2023. On one hand, the decline of early movers should be celebrated; on the other, watching profit-motivated entities outcompete relays that have long operated as public goods is something to watch closely.

Looking to the Future with ePBS

Today’s PBS is a failure of mechanism design that both encourages the geographic centralization of all participants and the misallocation of computational resources. Rather than incentivizing builders to produce the best block, the open candlestick auction pushes builders to maintain the most profitable leading bid for as long as possible. Instead of improving outcomes for order flow, proposers, and The Network, builders focus on optimizing bidding strategies, minimizing builder–relay latency, and pursing business development to acquire exclusive order flow.

By enabling trustless exchange between proposers and builders, ePBS supplants the status quo colocation incentives and offers a much-needed reset of market structure. It effectively transforms every builder into a relay, allowing builders choose any location with a meaningful density of proposers and removing the need for geographic chokepoints.

In sealed-bid ePBS, the importance of bidding latency recedes. Instead of each builder submitting thousands of bids to various relays—which magnifies the value of colocation, proposers have a direct, pull-based connection to builders, and each allowlisted builder only needs to submit a single well-timed bid. In this scenario, the competitive advantage shifts to quickly incorporating order flow and assembling the highest quality block.

As a result, chokepoints disappear and incentives align more cleanly for all participants. The future is bright with ePBS.