We are very excited to announce the publication of data for Flashbots Protect and MEV-Share! The transaction level data is available on three platforms, covering the history of Protect transactions since February 2022 and MEV-Share since April 2023.

The data is accessible on 3 platforms:

- Flashbots Data

- Flipside Crypto

- Data tables:

external.flashbots.fact_protect_transactionsexternal.flashbots.fact_mevshare_transactions

- Dashboard (by

@charliemktplace): flashbots-101 | charliemarketplace | Flipside

- Data tables:

- Dune Analytics

- Data tables:

dune.flashbots.dataset_protect_transactionsdune.flashbots.dataset_mevshare_transactions

- Dashboard: https://dune.com/flashbots/flashbots-protect-mevshare

- Data tables:

What is Flashbots Protect?

Flashbots team launched Flashbots Protect in October 2021 - a private mempool RPC product that allow users to transaction with frontrunning and revert protection. Transaction information stays confidential when broadcasted, and especially those with MEV-value (DEX swaps, token mints, liquidity provisions) - are protected from front-running and sandwich attacks from MEV bots. Transactions sent to Protect are not executed if they revert, so users don’t pay for failed transactions.

After the Merge, transactions sent to Protect RPC are forwarded to block builder through their RPC endpoints - with Flashbots builder as the default selection. In July 2023, we enabled a feature that allows users to specify additional builders to share their transaction with in order to improve landing time.

Users can go to either:

- The Flashbots Protect landing page: https://protect.flashbots.net/

- Or our developer docs to configure their RPC link with customized privacy and builder settings.

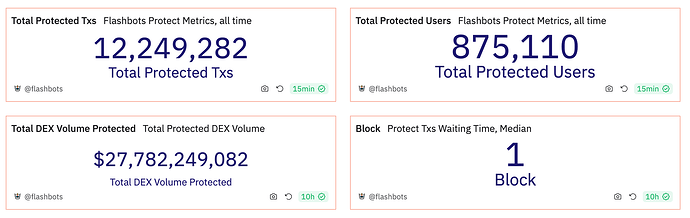

In the past 2 years, over 12 million transactions have been sent to Flashbots Protect (including the eth_sendPrivateTransaction endpoint and RPC) and landed onchain. A total of ~900k addresses have been protected from potential front-running, sandwich attacks, and reverts. These transactions have together accounted for over $27 billion of DEX trading volume. The overall median time to land a Protect transaction has been 1 block.

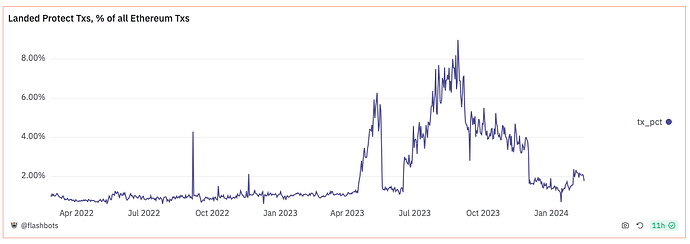

The overall transaction flow Protect received has been growing steadily since launch, with a major spike (up to over 80k transactions per day) during last year. This spike is identified as the transaction flow from the Maestro Telegram Bot, who switched from private RPCs to bundles submission endpoints. Flashbots Protect makes up roughly 2% of all transactions landed onchain today.

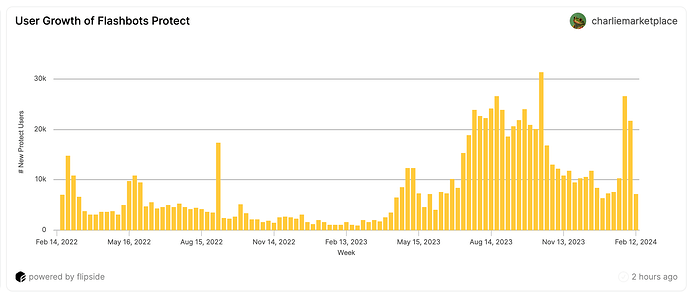

User wallet (who sends the transaction) growth follow the same pattern of increase with a spike in last year, and now stays around ~10k daily.

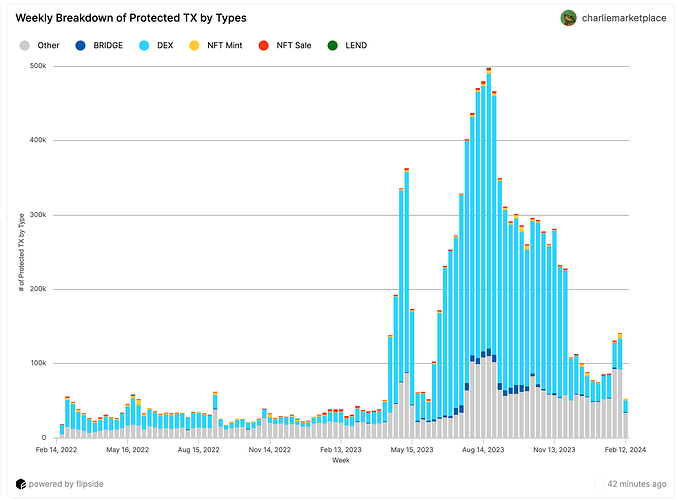

Based on Flipside Crypto’s dashboard, we are able to see the majority order type among Protect transactions are DEX swaps, as well as a small amount of NFT mint and sale - who are sensitive to MEV. During the spike, DEX swaps made up more than 80% of all transactions, along with some bridge transactions.

Starting from the launch of MEV-share in April 2023, transactions submitted to Flashbots Protect are also sent through MEV-Share. Sending transactions to the Protect RPC today is equivalent to sending to the MEV-Share order flow auction (OFA) with default configurations.

What is MEV-Share?

MEV-Share is the Order Flow Auction (OFA) product from Flashbots, sharing MEV profits back to users, with parameterized privacy features.

What does this mean? Typically, a user transaction’s life cycle will look like this:

- User submits a transaction through Protect RPC to our private mempool, with their choice of transaction “hints” to be shared in public streaming endpoint (see in advanced options in docs). User can also choose to share transaction to other builders besides Flashbots to get included on chain faster.

- Your transaction’s hints will be streamed to MEV-share searchers here for scanning MEV (backrun-only) opportunities. Searchers are checking the stream of transactions permissionlessly, but can only see the information (”hints”) user configured to be shared.

- Once there is a backrun opportunity, searcher submits a bundle here which - after successful simulation - will be forwarded to the list of block builders specified by users (default to Flashbots builder only, if not specified).

- If the bundle successfully lands on chain, user will receive 90% of the backrun profits searchers extracted against the user transaction; 10% goes to the block proposers. User can also change this default refund percentage when sending their transactions.

MEV-Share is built from the ground up to be highly configurable. We are publishing aggregated information from users’ configurations as follows (in protect_transactionsdata table):

hints_selected: The hints shared by the user for public streaming to searchers in the MEV-Share OFA.num_of_builders_shared: The number of block builders the transaction was shared with, higher number will likely result in faster inclusion speed on chain.refund_percent: The percentage of OFA backrun profits refunded to the sender (user). The rest can be kept by builders or bid to payout to validator. Flashbots builders keeps 0 profit and send the remaining profit to the block proposer at the end of the block.

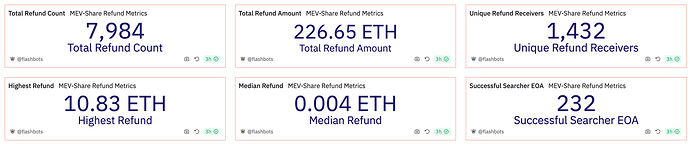

In the past 10 months after its launch, MEV-Share had ~8k successful backruns with a total of 227 ETH refunded to users. Over 1.4k users have received ETH by sending their transactions to Flashbots Protect / MEV-Share. The highest refund was 10.83 ETH in one single transaction. The user who received the most refunds had a total of 183 refunds.

Among the most successful searchers, the No.1 searcher by number of landed bundles had 1237 backruns and 16.44 ETH refunded to users from profits; the second highest had 819 backruns and 27.04 ETH refunded.

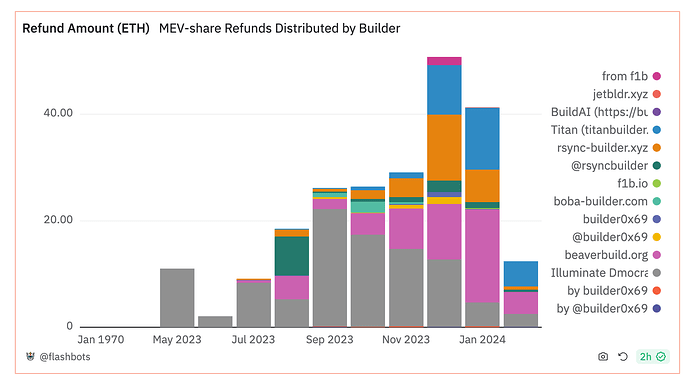

Since the launch, MEV-Share’s monthly refund ETH has grown to an average of ~20ETH as of November 2023, and spiked up to almost 2x in the December month. Along with the adoption of the builder sharing feature, we also saw that more and more MEV-refunds are distributed through other builders besides Flashbots, specified by users in their transactions.

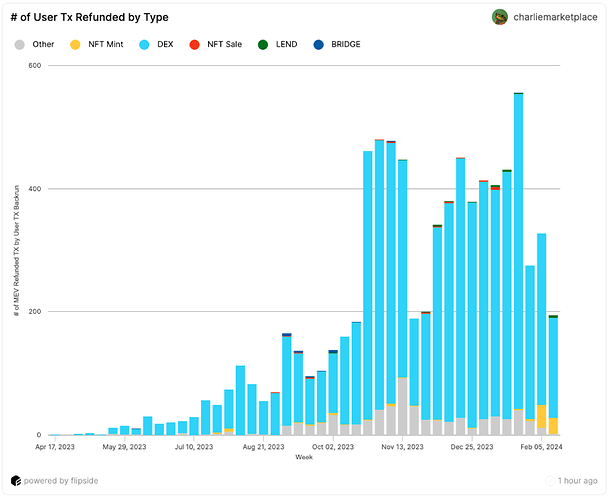

Across all the user transactions which received refunds, over 90% are users making DEX swaps; in the recent weeks, NFT mint transactions also starting to pick up with successful backruns, making up to 10% of all the refunded user transactions.

Typically, the bundling rate (transactions receiving successful backrun) is less than 1% - this is largely due to MEV-Share’s privacy preserving design: most of the hints shared from user transactions give very little information for searchers to construct their backrun effectively. Hence, the MEV-Share OFA’s searcher’s refund landing rate (successful backruns compared to the total bundle submitted) are much lower than an OFA sharing full transaction information. The nature of hidden privacy means that searchers must implement blind backrun strategies, which usually induces more attempts trying with different parameters.

Open Research Questions

There are more questions to be researched on the topic of OFA :

- The orderflow sharing across stack (RPCs, builders) and its implication on user outcomes

- The issues (privacy leaking, backrun invalidation, data tracing difficulty) with multiplexing behavior across multiple OFAs

- The privacy efficiency frontier: what’s the optimal threshold of privacy sharing that strikes a balance between efficient value extraction and low cost of leakage?

We wish to share this data to enable more discussions and research around the study and design of MEV-mitigation solutions, as well as the value redistribution to users in the MEV supply chain. We believe by enabling the community to gain more insights through proprietary data, it will foster collaboration, transparency, and the collective understanding of MEV dynamics, and ultimately driving more solutions for MEV in the field.

Please contact and reach out if you would like to report issues, share your insights, or contribute!

Thanks to Flipside Crypto, Dune Analytics teams’ help uploading the dataset into their paltforms, as well as contribution from Flashbots mates @elainehu @taarushv @Fred @shea @Tymur @sukoneck !