Hey! This is indeed a problem, I haven’t thought through what being able to buy blocks for cheap means (aside from lowering cost of attack).

We have thought about multi-block MEV generally in the past, and the potential for the same entity to propose consecutive slots (this is a problem regardless of PBS). We briefly talked to the Uniswap & Euler teams about this and wrote a draft memo on what it means. I believe there were short-term band-aids possible where the oracle could be calculated over more slots but nothing convincing. I’ll ping them to answer here!

A few links for you in the meantime:

- Why is Oracle Manipulation after the Merge so cheap? Multi-Block MEV. - Chainsecurity

- TWAP Oracle Attacks: Easier Done than Said?

- Statistical analysis on Ethereum k-consecutive block proposal probabilities and case study - Alvaro Revuelta

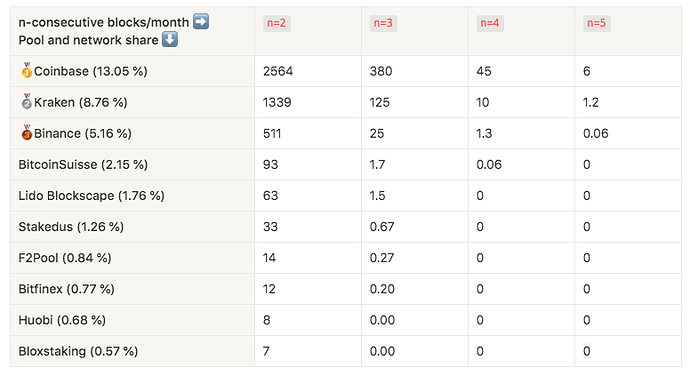

For that last link from Alvaro, here is the tldr table at the end of the article, where columns are numbers of consecutive blocks, and rows are % of stake owned.

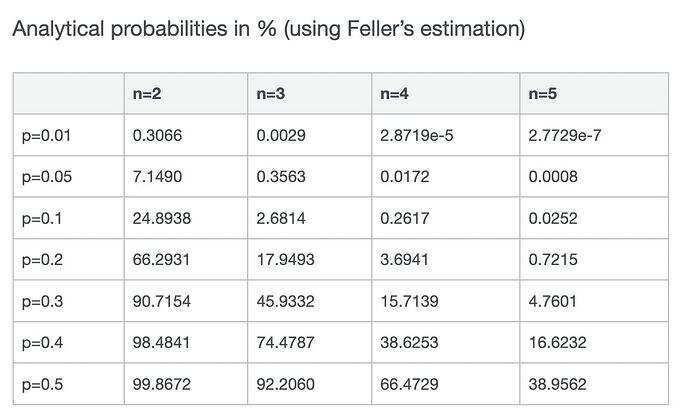

and here are early theoretical results, also from Alvaro: