We would like to thank @Tina, @mikeneuder.eth, @Nerolation, @dmarz, @Hasu and @metachris for helpful comments and discussions.

Today marks the one-year anniversary of the Merge and activation of MEV-Boost. To celebrate, we’re sharing this recap with data insights and trends from the first year of out-of-protocol PBS on Ethereum. We will begin by looking at the adoption of MEV-Boost from proposers, followed by a summary of the behaviors we’ve seen from relays, block builders, and searchers.

The Rapid Adoption of MEV-Boost

The Merge brought significant changes to Ethereum as the responsibility of block production shifted from a handful of mining pools to thousands of stakers all over the world. The change also resulted in a hard reset of the MEV infrastructure of Ethereum. Any previous relationships between searchers and miners faded as this new set of proposers took control.

One year before the Merge, Vitalik introduced the concept of Proposer/Builder Separation (PBS) as a direct response to the risk that MEV would pose on PoS Ethereum. Left unattended, MEV would accrue to the proposers with the most sophisticated infrastructure and relationships with searchers. This would discourage solo staking, promote economies of scale, and threaten the credible neutrality of the network.

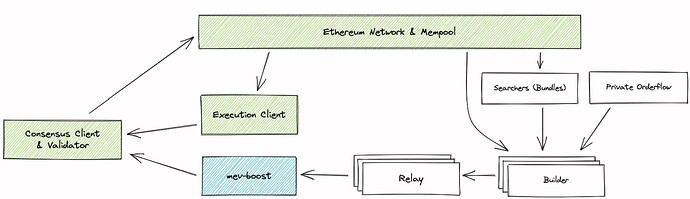

In collaboration with CL-clients, the Ethereum Foundation, and the Eth2 Working Group, Flashbots developed MEV-Boost as an interim PBS solution that do not require any changes to the core protocol. Available as a sidecar for all CL-clients at the Merge, MEV-Boost achieved out-of-protocol PBS and established an open, competitive marketplace for block builders. Through this separation, MEV-Boost democratized access to MEV and allowed all validators to participate on an equal basis. This is especially important for solo validators, who would otherwise not be able to participate and be cut off from any MEV revenue.

From the MEV-Boost documentation: Out-of-protocol Proposer/Builder separation via MEV-Boost

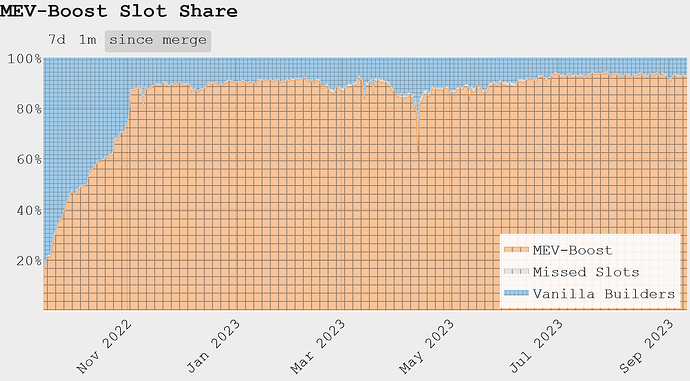

After the Merge, MEV-Boost saw rapid adoption with 50% of all validators running it within the first month, and 90% by the end of the second month. Proposers that outsourced their block building through MEV-Boost received the same median block reward, thus mitigating the centralizing forces MEV would otherwise pose on Ethereum’s validator set.

From mevboost.pics: Percentage of blocks sourced from MEV-Boost since the Merge

From mevboost.pics: Block rewards to the largest staking entities in the last 6 months

Proposer revenue and notable events

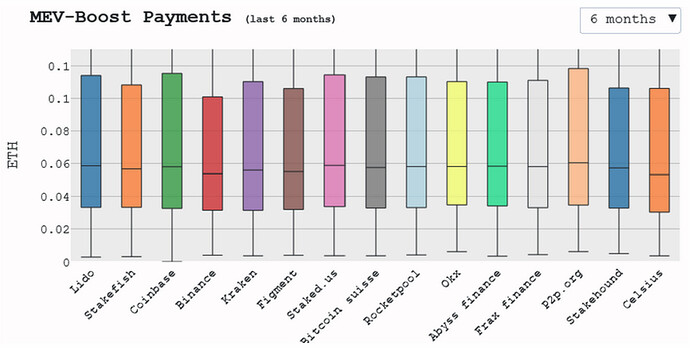

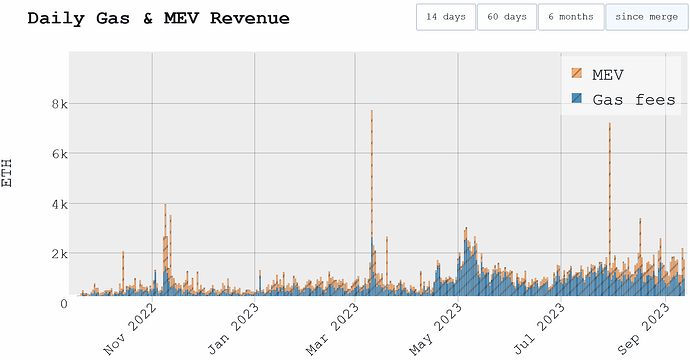

In Ethereum’s first year of PBS, validators received over 300,000 ETH from the blocks they proposed, including both gas priority fees and MEV. While gas priority fees generally constitute the majority of proposer revenue, MEV payouts can significantly surpass gas fees in periods of high market volatility.

From mevboost.pics: Daily gas and MEV revenue for proposers since the Merge

Three periods of large MEV payouts are noticeable in the last year. We’ll briefly expand on these events here, additional details can be found in our Transparency reports and in this talk by @elainehu.

- Nov 9th, 2022: After the FTX collapse, we witnessed five days of market liquidations resulting in 14,585 ETH paid to proposers in total from gas priority fees and MEV.

- March 11th, 2023: As a result of the SVB bank run and USDC de-pegging, a surge in onchain activity was triggered which resulted in proposers receiving a total of 7,694 ETH.

- July 30th, 2023: Following the cascading events of the Vyper exploit, arbitrageurs were competing to clear out the price difference on the de-pegged assets across Curve pools. A total of 7,187 ETH was paid to proposers. During the turmoil, a single transaction paid 570 ETH to ensure the inclusion of a trade that cleared out arbitrage between Alchemix ETH and Frax ETH, the second highest by MEV payouts so far in Ethereum history.

The highest-ever single MEV payout transaction originated from the whitehat c0ffeebabe.eth to Beaverbuild for a whooping 678 ETH as a result of them frontrunning a vulnerability discovered in a contract and returning the funds before it was exploited. Beaverbuild forwarded this MEV to the block proposer to win the bid.

The Relay Landscape

MEV-Boost introduced the role of mutually trusted relays that sit between builders and proposers, responsible for validating blocks and escrowing block bodies. Anyone can run a relay and proposers are able to register to as many relays as they trust. To help bootstrap a diverse and healthy relay market ready at the Merge, Flashbots open-sourced our relay a month in advance, under an LGPL copy-left license. Blocknative followed suit by open-sourcing their implementation as well.

As Ethereum transitioned to Proof-of-Stake on September 15, validators could connect to 7 different relays, which in turn received bids from 27 unique block builders. In order to not enshrine the Flashbots relay, we deliberately avoided setting it as a default in MEV-Boost.

The censorship concern

The rapid adoption of MEV-Boost still outpaced our effort to bootstrap a diversified relay market. In the month leading up to the Merge, OFAC added Tornado Cash contract addresses to their sanction list. This resulted in many relays, Flashbots included, choosing not to accept blocks containing these transactions. Due to the way MEV-Boost is architected, there is a full separation between block builders and proposers. Validators have to blindly sign the block they are proposing without being able to add any further transactions and circumvent this censorship.

The Flashbots relay was the only permissionless relay at the Merge, allowing any builder to submit bids. Relayooor, the second permissionless relay and the first not to censor, started operation on October 26. Even still, the Flashbots relay stood unrivaled as the most popular during the first months, culminating on November 11 as it relayed 69% of all new Ethereum blocks. The percentage of blocks sourced from all censoring relays combined hit an all-time high on November 21, with 79% of all new Ethereum blocks.

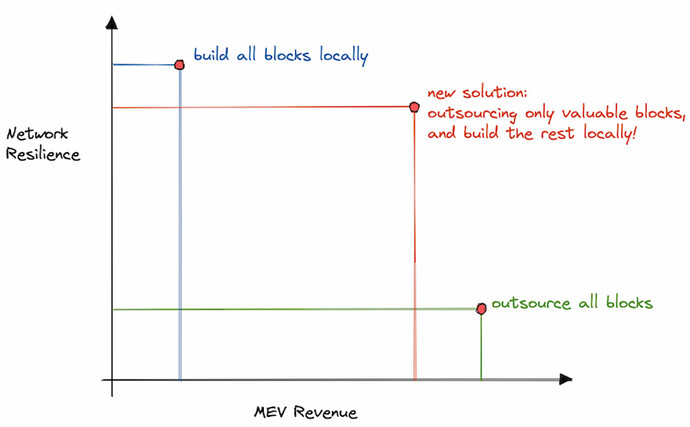

On November 22 we published The Cost of Resilience. The post encouraged validators to utilize the newly added -min-bid flag to propose locally built blocks if the bid from MEV-Boost was under this minimum bid value. By using this feature, validators would no longer risk missing out on high-value MEV-Boost blocks while still being able to uphold Ethereum’s network resilience by proposing content-agnostic, locally built blocks in times of low MEV.

From The Cost of Resilience: The proposer tradeoff between network resilience and MEV revenue introduced by min-bid

On November 30, two new permissionless and content-agnostic relayers were announced – Agnostic Relay and ultra sound relay. To support their initial growth, the Flashbots builders started sending them blocks the following week. Furthermore, we published a technical guide and knowledge base on Running MEV-Boost-Relay at scale to assist anyone in efficiently operating their relay infrastructure. Aestus began operation in December as the fourth content-agnostic and permissionless relay, increasing the total number of relays to 11.

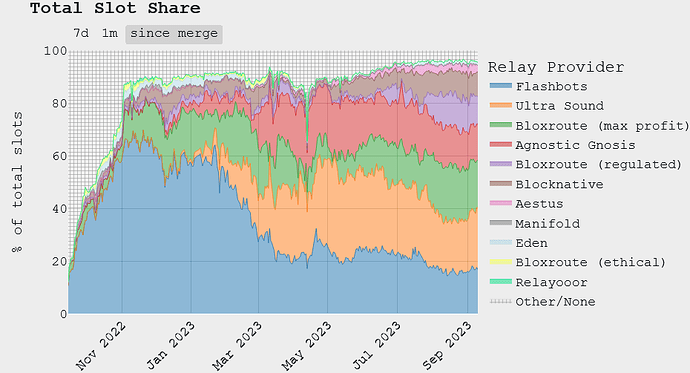

Diversification and stabilization of the relay market

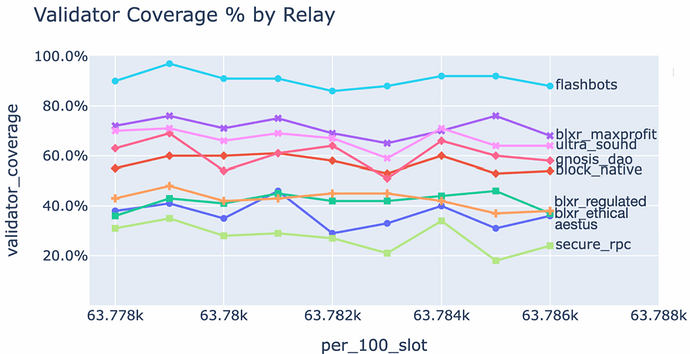

While the Flashbots relay remains the most popular to register to by validators to date, a considerable diversification in terms of slot share has occurred in the last six months. In April, both Agnostic relay and ultra sound relay grew to the same slot share level as the Flashbots relay. As of today, ultra sound relay and BloXroute are in the lead, and even though the top 6 relays have a combined 90% market share, no single relay exceeds 25%.

From Relay Data API: Validator coverage by relays, snapshot between slot 6377800 and 6378800

From mevboost.pics: Total slot share by relays since the Merge

The number of blocks sourced from censoring relays reached a low of 17% in April. The trend has since increased, now nearing 30%. Notably, less than 2% of blocks post-Merge have included one or more transactions interacting with sanctioned addresses. Due to the rarity of these transactions, the vast majority of blocks sourced from censoring entities have not actually delayed any unconfirmed transactions from being included onchain. Additionally, as these transactions do not rely on timely inclusion, they were at no risk of failing as a result of the added delay.

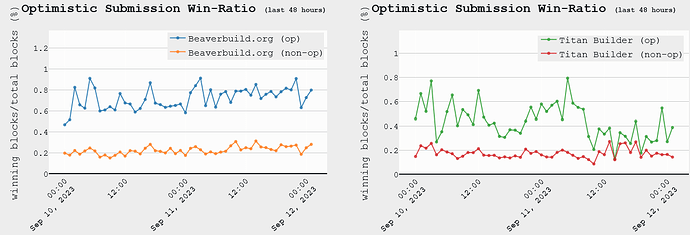

Latency reduction with optimistic relay

In order to reduce latency in block production, ultra sound relay introduced the concept of optimistic relaying. In optimistic relaying, the block is immediately forwarded to the proposer without first being simulated by the relay to ensure its validity. This saves the relay ~100ms and allows the builders to build higher-paying blocks, thus giving the relay an advantage over the competition. To ensure builders act in good faith, they are required to put up collateral with the relay.

This has led to builders being able to be more agile with adjustments right at the end of the slot. The charts below show that optimistically submitted bids by Beaverbuild and Titan Builder have almost three times higher win rates than their normal bids. ultra sound relay activated optimistic relaying on March 17 and remains the only relay with this feature effectively utilized.

From mevboost.pics: Beaverbuild and Titan Builder bids win rate by submission type

Relay exploit on April 3

On April 3, a vulnerability in mev-boost-relay was exploited by a malicious proposer to manipulate the ultra sound relay and drain roughly $20M from multiple sandwich bots. The malicious proposer received the block body from the relay, unbundled the sandwiches they had baited searchers to create, and sandwich their trades. The exploit allowed the proposer to send an invalid header to the relay to ensure that they would win the block equivocation race.

The vulnerability was patched the same day, however in the following days the network saw an increase in the number of forks. A timeline of how the event unfolded and how it was resolved can be found in the post-mortem. Additional information on equivocation attacks, in which a malicious proposer double-signs a header in an attempt to unblind a builder block can be found in Equivocation attacks in mev-boost and ePBS and Time, slots, and the ordering of events in Ethereum Proof-of-Stake. The incident also sparked a conversation on client diversity among the MEV-Boost relay operators.

The Evolution of the Builder Market

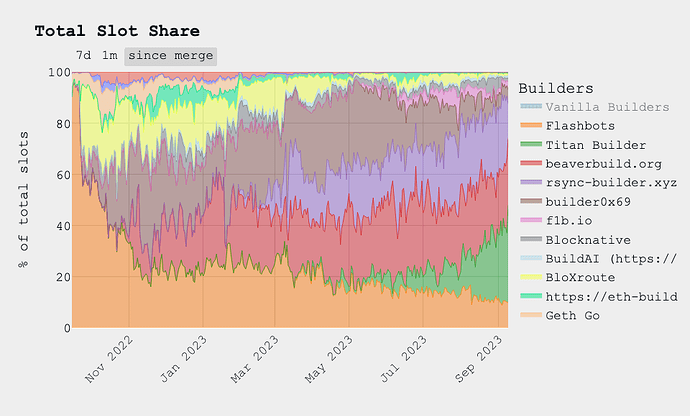

Right after the Merge, the Flashbots builders initially won 95% of blocks sourced from MEV-Boost. But in contrast to the relay market, diversification in block building happened faster. After just a week, Flashbots builders dropped below 60% as BloXroute entered the scene, capturing 25%, and other early adopters like Blocknative and builder0x69 started to win blocks. In November we open-sourced our block builder and saw even more builders come online.

Beaverbuild entry to the scene in January further decentralized the landscape, with no entity now producing more than 30% of blocks. However, Beaverbuild’s unique position as a searcher-builder with access to exclusive high-MEV arbitrage flows gave them an important competitive edge. The vertical integration allows Beaverbuild to produce 40-50% of blocks during short intervals of high market volatility, far outcompeting other builders and momentarily centralizing the market.

More competitive builders have entered the market and gained substantial market share since, with rsync in March and Titan Builder in May. In contrast to the relay market, the builder market is fueled by economic incentives. The landscape is still very contested, with new actors entering the scene and strategies being refined to win over the competition. As of publishing this report, the top 4 block builders constitute 90% of the total market share.

From mevboost.pics: Builder slot share since the Merge from MEV-Boost

The block building landscape has evolved into a complex game involving various strategic approaches by builders to get an edge over their competition, such as:

-

Vertical integration of searcher-builder: Given the 12-second block time of Ethereum, searchers who engage in off-chain high-frequency markets like Binance benefit from more control on trade finalization and inclusion. As a result, it makes economic sense for searchers to become builders as well. It’s worth noting that the CEX-DEX arbitrage constitutes a large part of searcher-builder strategies and is heavily dependent on access to off-chain capital.

Onchain data indicates that searchers often consider searcher-builders less trustworthy than neutral builders. Some searchers strategically avoid sending to these entities to mitigate the risks of data leakage or censorship, particularly when competition on the same flow is probable. With the emergence of multiple searcher-builders, searchers need to strategically reason about which builder(s) to send their bundles to.

-

Strategic bidding: builder0x69 was the first notable builder to diverge from merely bidding the total value of the block. They adjust their bids to sometimes be higher than the block value by subsidizing blocks with their own funds, and at other times lower the bid and take profits. By subsidizing blocks they have a higher chance of winning the slot, raising their market share and thereby attracting more private order flow. This strategy is increasingly being adopted by new entrants in the builder landscape today.

-

Orderflow sharing: With the rise of Order Flow Auction like MEV-share and MEVBlocker, as well as Telegram Bots that require private mempool settlement, builders face increased pressure for swift transaction inclusion to optimize user experience. Constraint by the decentralized nature of the builder market, sharing order flow among builders has emerged as a solution to speed up inclusion time. This practice complicates the tracing of orderflow, until more standardized solutions are developed.

-

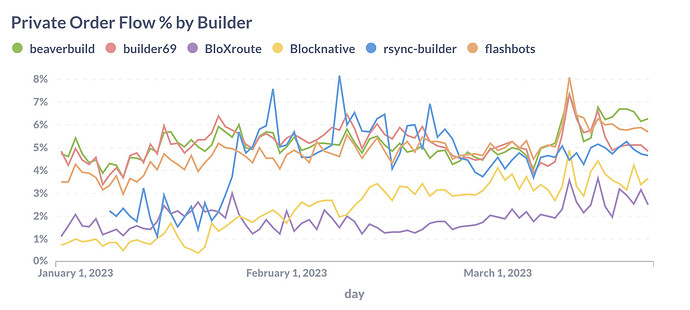

Private orderflow acquisition: Acquiring private order flow containing MEV value is important for building competitive blocks. Most prominent builders have already adopted private orderflow, either through their RPC endpoint products or exclusive deals purchasing flow from applications.

From Flashbots Internal: Percentage of transactions builders included in blocks, not seen in the public mempool

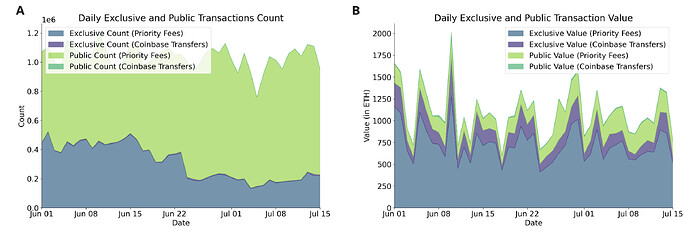

A deeper analysis of the strategies used by builders is presented in the Empirical analysis of Builders’ Behavioral Profiles (BBPs) by Thomas Thiery. The research introduces a collection of metrics used to describe how builders build blocks and act in the MEV-Boost auction, offering insights into their strategies and optimizations. During the period from June to mid-July, the dataset reveals that exclusive order flow accounts for approximately 25-35% of the total transaction count across all builders, yet constitutes 80% of the total value.

From Empirical analysis of Builders’ Behavioral Profiles (BBPs): The importance of exclusive order flow for block builders

A primary concern of the current PBS architecture remains that of builder centralization and censorship resistance. MEV-Boost doesn’t create these centralizing forces, MEV does, MEV-Boost merely shifts the risk from the validator set to the builders, where it is easier to address.

Searcher Profits Post-Merge

Atomic MEV: Majority of profits are paid to proposers

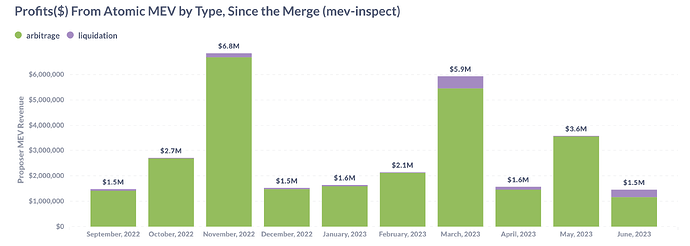

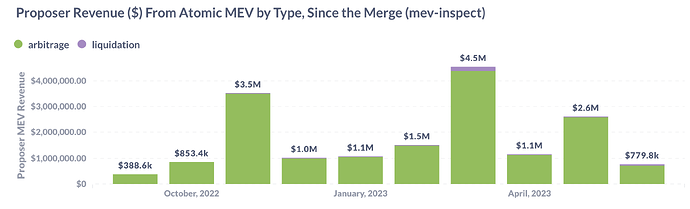

Using mev-inspect-py to identify atomic MEV, such as arbitrage and liquidations, we are able to quantify monthly profits from atomic MEV hover around $2 million, spiking to $4-6 million during periods of high market volatility.

From mev-inspect-py: Profits from atomic MEV by type since the Merge

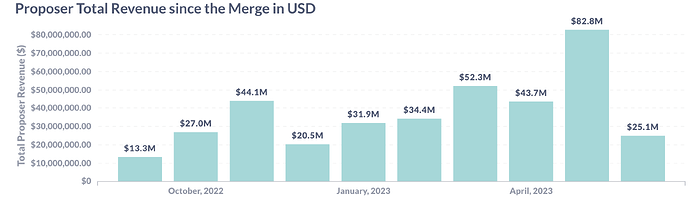

We estimate that the total proposer revenue benefited from atomic MEV transactions falls within the $1-4 million range. When compared to the overall proposer revenue for the same timeframe, this accounts for only 5-10%. Note that this is a conservative lower bound estimate, limited by the scope of mev-inspect-py.

From mev-inspect-py: Proposer revenue from atomic MEV txs vs. total

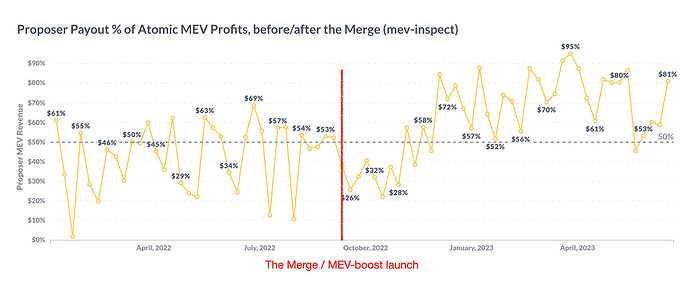

Prior to the Merge, searchers had to increase gas prices to prioritize their transactions within blocks. Post-Merge, with the adoption of MEV-Boost, searchers now include additional tips through the MEV payouts to prioritize their bundles, in addition to the standard gas fees. The percentage of total MEV paid to the proposers shows an interesting paradigm shift before and after the Merge:

- Pre-Merge, the proposer’s share of MEV revenue was on average below 50%.

- When MEV-Boost had just launched and there was little competition between builders, the profit share searchers’ forwarded to the proposer dipped, before trending upwards again.

- Starting in 2023, as more builders entered the space, the share forwarded to proposers has stabilized above 50%. Proposers are increasingly capturing the majority of atomic MEV profits, at times making as much as 80-95%.

From mev-inspect-py: Proposer payout percentage of atomic MEV profits before and after the Merge

Non-atomic MEV: Higher revenue, higher margin

Searchers can engage in cross-market arbitrage, involving both DeFi and CeFi platforms… Tracing these profits becomes particularly challenging as one leg of the trade exists off-chain. In A Tale of Two Arbitrages it’s concluded that:

“…Comparison of atomic and CeFI-DeFi arbitrage over Q1 2023. CeFi-DeFi generated $37.8M revenue in Q1 2023 compared to the $25M revenue of atomic strategies. 91-99% of the revenue from atomic arbitrages is paid to the validator for inclusion, whereas only 37-77% of CeFi-DeFi revenue is paid to validators for inclusion.”

This helps us estimate that non-atomic MEV flow ultimately contributes a similar amount to proposer revenue compared to atomic MEV; while searchers get to keep a much higher profit margin from the total revenue.

Final Remarks

The future of PBS

MEV-Boost was developed as an interim solution for Ethereum PoS until research on in-protocol, enshrined PBS had matured as part of Ethereum’s roadmap. Relays were initially seen as a temporary component in the current out-of-protocol PBS structure but will most likely continue to play a role even in enshrined PBS. There is still work to be done regarding relay diversification, and we are committed to encourage open, permissionless, and transparent MEV marketplaces through open-sourcing our work, sharing our learnings, and engaging in discussions.

To help support the present and future research, development, and operations of PBS on Ethereum, the MEV-Boost community has jointly proposed PBS Guild. PBS Guild is a non-commercial ecosystem R&D funding vehicle to support PBS ecosystem R&D. It sets out to tackle the short, medium and long-term research, development and operations challenges in PBS, with a mandate of decentralization. The initial phase aims to raise $1 million for independent relays, R&D, data transparency, and PBS education.

Illuminating with data transparency

With the MEV supply chain evolving into a complex supply network, tracking the orderflow lifecycle across the stack becomes challenging. While MEV-Boost’s open Relay Data API facilitates visibility into the final steps prior to onchain settlement, tracking an order’s initial entry point remains elusive.

Flashbots remain devoted to providing transparency in the MEV ecosystem and supplying data for research to contributors and collaborators. The recently released Mempool Dumpster offers historical mempool transaction data aggregated from five different node providers. It aims to provide free and easy access to data for any community research or builder developments.

To ensure good data quality and increase protocol coverage, we are inviting contributors to maintain and improve mev-inspect-py through a new data grant. Reach out if you’re interested in learning more!

Looking ahead

Ethereum’s transition to Proof-of-Stake, paired with the rise of MEV-Boost has fundamentally reshaped the dynamics of the transaction supply chain. While this accomplishment is substantial and deserves celebrating, the centralizing force of MEV will continue to pose inherent challenges to the neutrality and decentralization of blockchains. The road ahead is lined with research, spirited debate, and innovation to ensure these centralizing effects are meticulously countered. The journey of Ethereum has always been one of community-driven evolution. As we venture into the next chapter, let’s channel our collective energy to preserve the ethos that brought us here. The future is exciting, and together, we are up to the challenge.