How the MEV Supply Chain Reacts to Circuit Breakers

Data Always - Flashbots Research

December 16, 2025

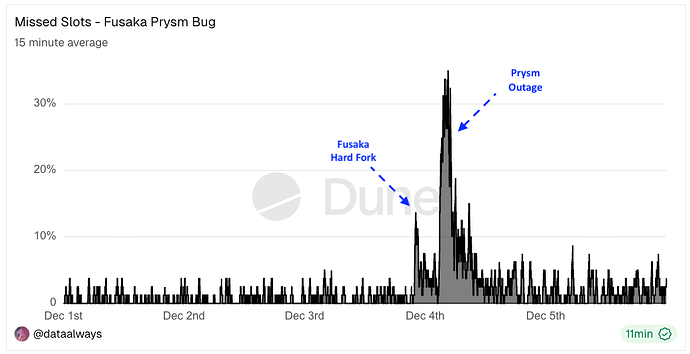

Shortly after the Fusaka hard fork on December 4, 2025, a bug in the Prysm consensus client knocked nearly all Prysm nodes offline. Although the chain stayed up and the Network never stopped finalizing, this was one of the largest liveness degradations in the history of proof-of-stake Ethereum:

- The fraction of missed slots peaked above 30%.

- December 4 had the second-most missed slots of any day since The Merge.

- The hours between 03:00 and 05:00 UTC recorded the second and third highest missed slot counts of any hour since The Merge.

The current design of proposer–builder separation (PBS) is out of protocol: nodes on the Network do not know whether blocks were sequenced locally by the proposer or outsourced to a builder. Another level deeper, nodes also lack visibility on which parts of the MEV supply chain were involved in block construction and relaying. As a precaution stemming from the lack of information, when the Network experiences high levels of instability, consensus clients activate circuit breakers that cut off out-of-protocol block building and fall back to local sequencing.

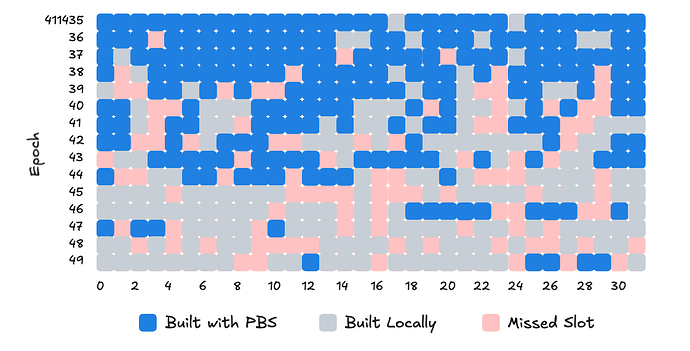

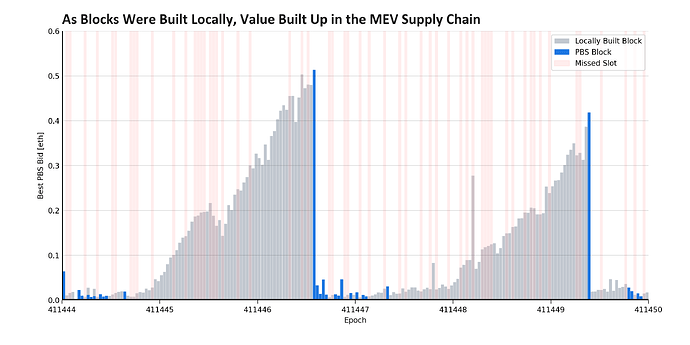

Per Prysm’s postmortem, network degradation began in epoch 411,439. Visualizing the sequencing of slots in the diagram below, we see that before the incident about 90% of blocks were built via PBS. However, starting around epoch 411,440 there is a large uptick in both missed slots and locally sequenced blocks.

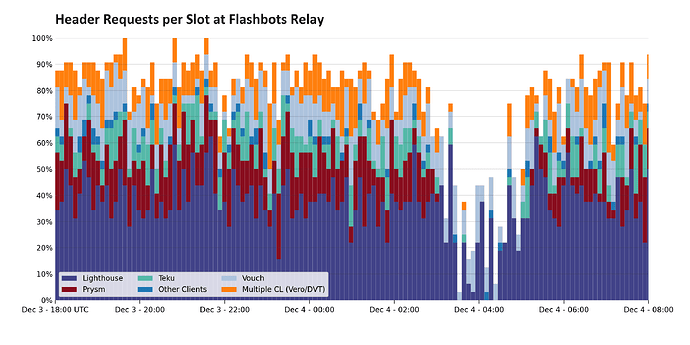

By epoch 411,444 (Dec 4, 2025 03:21:59 AM) circuit breakers had fully triggered. Proposers ceased asking relays for headers, leading to long stretches without outsourced block building. Although the bug was unrelated to the MEV supply chain and the Network remained live and finalizing, relays and block builders ceased to be active participants.

The reason that this is interesting is that, over the past two years, state-contentious transactions have become reliant on private mempools and order-flow auctions. Under normal conditions, these mechanisms allow for significantly better execution by both shielding transactions from frontrunning and by rebating MEV generated by pool imbalances. However, this order flow is only available to block builders.

This begs the question: how did DeFi hold up?

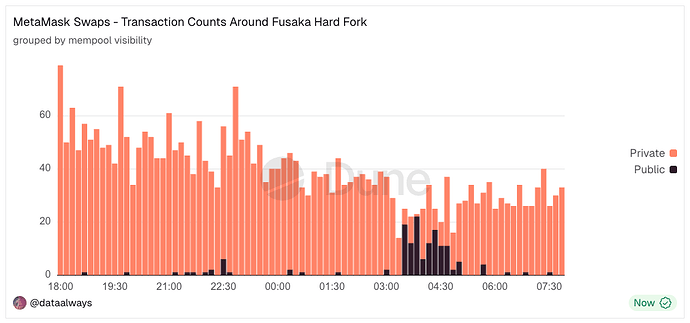

A demonstrative example is MetaMask Swaps, which under normal conditions routes more than 99% of user transactions through private mempools. During this PBS outage, private mempools became unviable, and we see that transactions were re-routed to the public mempool to ensure users could still get their transactions included onchain.

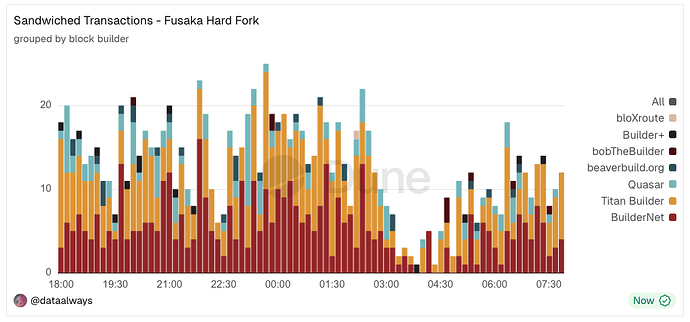

Routing these transactions via the public mempool is usually dangerous, but because sandwich attacks flow through block builders to mitigate unbundling risk, we actually saw a large drop in toxic MEV during the outage. This dynamic is only short-term stable: if the validator set had been slower to recover and circuit breakers had remained active longer, searchers would likely have adjusted and reverted to PGAs in the public mempool.

However, intelligent routing isn’t perfect. There were three sandwiched MetaMask Swaps during the period. All three transactions appear in the public mempool (1, 2, 3) and were likely mispredictions about who would sequence the next block. The U.S. dollar volume of the three transactions was over $5,000, while EigenPhi (1, 2, 3) estimates total loss for the users at $49. The sandwich bots profited $4.51.

This distribution of value is typical; competition for these arbitrage opportunities drives the majority of profit to the proposer.

Although many transactions were re-routed through the public mempool, extended stretches of locally sequenced blocks still produced a buildup of pending value in the MEV supply chain. During PBS outages, some classes of MEV accumulate—for example, pool balances can temporarily dislocate against CEX prices and eventually need to be arbitraged by searchers. Other forms of MEV do not: sandwich opportunities are transient because local builders include potential victim transactions onchain before they can be exploited.

The accumulated MEV was smaller than I would have predicted, likely due to depressed price volatility in the middle of the night.

The enshrinement of PBS in Glamsterdam offers some mitigation against future incidents. By bringing these markets into the protocol, validators gain visibility into which entities played a role in a failure, allowing consensus clients to be surgical in how they ensure Network liveness. In this situation, the lack of PTC data would have indicated that proposers had failed to select bids—clients could, in theory, have leveraged this information to determine that cutting off the MEV supply chain would not have improved the situation.

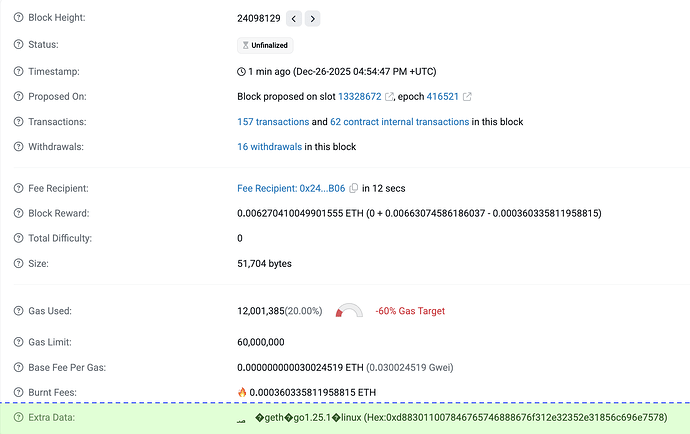

Appendix - Execution Layer Client Diversity

The sample is small, but the period of heightened local block building provides a less-biased snapshot of execution client diversity. Between epochs 411,439 and 411,479, 46% of locally built blocks were produced by proposers using Geth, while 31% were built by proposers using Nethermind. This contrasts with self-reported data from supermajority.info, which hints that Nethermind may now be the most widely used execution client.

| Slot Count | Period Market Share | |

|---|---|---|

| Geth | 175 | 46.4% |

| Nethermind | 115 | 30.5% |

| Besu | 63 | 16.7% |

| Reth | 15 | 4.0% |

| Erigon | 0 | 0% |

| No Extra Data | 9 | 2.4% |

Table: execution layer clients tagged by extra_data for locally built blocks from epochs 411,439 to 411,479.