Contingent Fees in Order Flow Auctions

This work was done from Nov-April under FRP-28

Abstract

Many early order flow auction designs handle the payment for orders when they execute on the chain rather than when they are won in the auction. Payments in these auctions only take place when the orders are executed, creating a free option for whoever wins the order. Bids in these auctions set the strike price of this option rather than the option premium. This paper develops a simple model of an order flow auction and compares contingent fees with upfront payments as well as mixtures of the two. Results suggest that auctions with a greater share of the payment contingent on execution have lower execution probability, lower revenue, and increased effective spreads in equilibrium. A Reputation system can act as a negative contingent fee, partially mitigating the downsides; however, unless the system is calibrated perfectly, some of the undesirable qualities of the contingent fees remain. Results suggest that designers of order flow auctions should avoid contingent fees whenever possible.

Paper

Summary

Contingent fees for order flow are fees paid when the order executes. This research started when I noticed that several MEV projects, including COWswap, ROOK, and had either implemented contingent fee auction designs or were considering implementing them. This paper is meant to illuminate one of the key drawbacks of contingent fees in order flow auction design which results from the optional execution of the transaction after it has been won in the order flow auction.

The model considers an order flow auction (OFA) in a single slot. The OFA happens early in the slot (so that transactions can make it into builder’s blocks) but as a result of this additional information is available when searchers choose whether to submit transactions relative to what was available when bids were submitted. In other words, the price of underlying assets may change between the time when the OFA concludes and the time when bundles are due for submission. This transforms the order flow into a very short-duration option. If the price moves too far in the wrong direction, the searcher who won the order flow in the OFA may choose not to execute the transaction because it is no longer profitable to do so.

Now that we understand why orders look like options from a searcher perspective, we can discuss the differences between upfront payments for order flow and contingent fees.

Contingent fees erode the value of the order flow because they make executing the order less likely to be profitable. An upfront payment is a sunk cost so it is just as profitable to execute an order that you paid 100 dollars upfront for as it is to execute an order that you paid 1 dollar up front for, \textit{ceteris paribus}. But, once you add a contingent fee, executing the order has to not only be profitable but also profitable enough to make up for the contingent fee.

The worry then is that there may be an unraveling since bidders can submit inflated bids in the hope that the price moves enough to offset the inflated contingent fee. Indeed we identify this unraveling in the model and its effects can be severe.

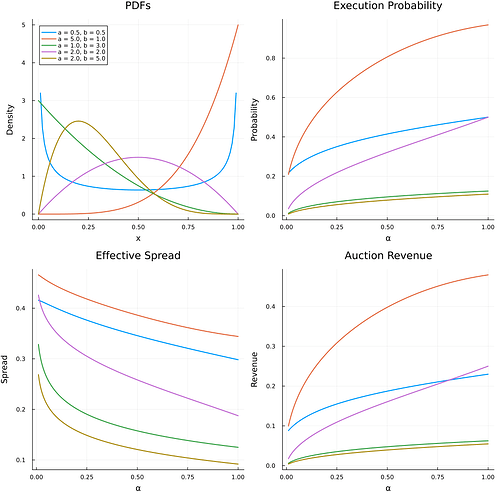

The parameter \alpha in the paper refers to the fraction of the bid which is paid upfront. Results suggest that higher \alpha auctions have increased revenue, increased probability of execution, and better effective spreads for traders.

Results are plotted for several volatility surfaces below: