Hi everybody!

We share the results of the work we have developed in the context of the FRP 21 - MEV in fixed gas price blockchains. Any comments/suggestions are welcome!

Our project:

MEV has been extensively studied, from mathematical models to data analysis applications. In most studies, researchers have worked with the Ethereum blockchain almost exclusively, so extending the studies to other blockchains could help broaden the scope of MEV research. Understandably, one of the most important aspects of MEV is gas bidding.

In Ethereum, the miners include transactions from the mempool and propose a block with a subset of transactions in an arbitrary order. However, this arbitrary order is not random; many miners use gas to sort transactions and create new blocks since this strategy maximises their rewards. This incentive increases the gas price to a point that makes the network almost impossible to use for normal users.

Although this incentive is common in Ethereum, it is not present in all blockchains. Many blockchains based on Tendermint don’t take dynamic gas prices into account to prioritise transactions. They use a fixed gas price and process transactions in the same order in which the validators receive them. This difference could heavily impact the role and behaviour of MEV searchers. In blockchains with fixed gas prices, the only resource that searchers have is to recognize an MEV opportunity before other actors and respond quickly. This contrast could have enormous repercussions on the opportunities that MEV searchers choose to pursue. At first, there would be no possibility, by non-privileged users, of positioning one transaction ahead of another once the first one was already broadcasted. This restriction would forbid extracting value based on front-running and sandwich strategies, leaving only back-running as a resource for searchers. Even though searchers only have this strategy, arbitrages could be performed.

We believe blockchains that don’t use gas to prioritise transactions present MEV opportunities with their own dynamics. As we have previously mentioned, even though MEV has been extensively studied (market designs and their implications, MEV in other blockchains, among others), to our knowledge, there is not a full understanding of MEV in blockchains with fixed gas price mechanisms. Therefore, we propose the following general objective: To study the MEV opportunities in a blockchain with fixed gas price. To contribute to this general object, we propose to study the Terra Classic blockchain during the period from September 2021 until the de-peg event in May 2022, with the following specific objectives:

Specific Objective 1: Study the characteristics of arbitrages in Terra Classic in the defined period.

Specific Objective 2: Understanding which strategies perform searchers to improve profit.

Specific Objective 3: Understanding the timing-related characteristics of arbitrage.

Specific Objective 4: Create a dashboard to help with the analysis of this data

Findings:

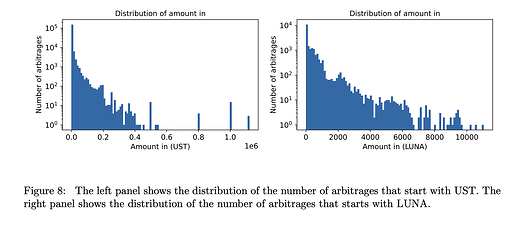

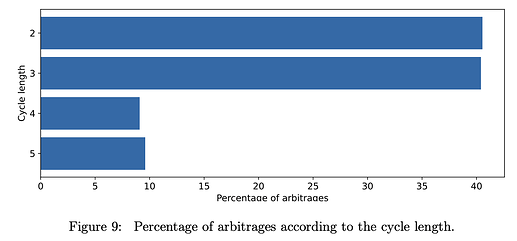

- We found more than 188K successful arbitrages, and most of them used UST as the initial token. The capital to perform the arbitrage was less than 1K UST in 50% of the cases, and 80% of the arbitrages had less than four swaps.

-

We found that searchers who use more complex mechanisms, i.e. different contracts and accounts, made higher profits.

-

We found that the most profitable searchers used a strategy of running bots in a multi-instance environment, i.e. running bots with different virtual machines

-

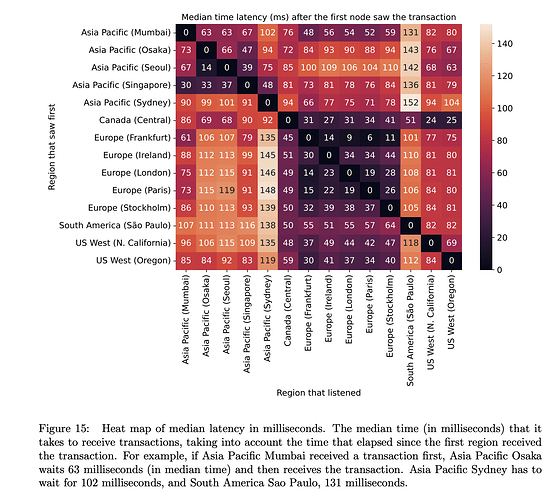

We measured the importance of the geographic distribution of the virtual machines that run the bots.

Main conclusion:

We found that having good geographic coverage makes the difference between winning or losing the arbitrage opportunities. That is because, unlike MEV extraction in Ethereum, bots in fixed gas price blockchains are not battling a gas war; they are fighting in a latency war.

Paper: [2303.04242] MEV in fixed gas price blockchains: Terra Classic as a case of study