Google is being sued by the US government for its behaviour in its ad auction businesses (being accused of Monopolist Extractable Value some might say). While the case is ongoing and consists of many complex arguments, there are a couple of high-level reasons we in crypto, and especially MEV, should care deeply about this.

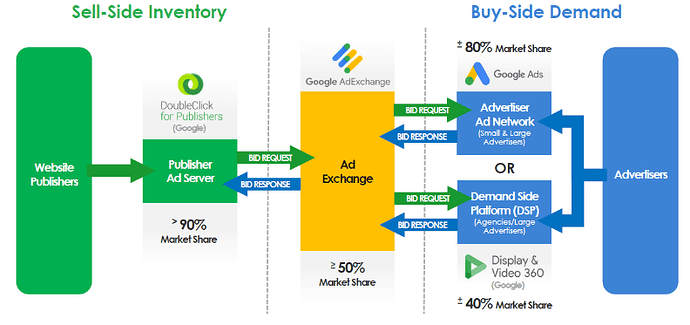

Google is accused of abusing the opacity of their systems, their privileged access to data and market position to unfairly impose barriers to competition in their markets. In contrast, we are pursuing competitive, transparent markets with low barriers to entry and privacy for those who seek it. This contrast is made even more stark by similarities in structure between the ad and DeFi markets (which i plan to about soon {}^{tm}), especially with the rise of telegram bots and off-chain compute engines.

More concrete reasons why to care:

- The arguments laid out in the case provide ample examples of what can (arguably) be considered unfair or anticompetitive behaviour in a more mature market than our own. We can look to these examples and attempt to avoid market structures and behaviours which have lead to them.

- The manipulations of ad auctions provides a perfect target use case for crypto once we have achieved sufficient scale

- Narrative-wise, the Google case provides a good example to point to and say “look, we are trying to fix this problem”

While I would love to write more of my own thoughts, these will have to wait for a while. In the meantime, I am creating this thread for others to post thoughts and resources - curious to hear what other’s think.

Relevant links: